Table of contents

- So much is changing in mobile marketing

- High-level: what changed in Q3

- Global mobile at a glance

- ATT opt-in rates

- Cost per install: global

- Regional CPI, CTR, CVR: top countries

- Ad networks & platforms: top gainers

- Ad spend growth and decrease by country

- Hottest genres with the most downloads: global

- Key metrics by vertical

- Platform ad spend share: iOS, Android, web

- Paid vs organic installs

- Partner contributions: Digital Turbine, Mobile Growth Association, RevX, yellowHEAD, Shamsco, Marcus Burke

Available in: English, Korean, Portuguese, Spanish & Chinese

So much is changing in mobile marketing

Google is under judicial threat of an antitrust breakup. Every large platform is pushing modeled probabilistic measurement to reduce dependence on SKAN for iOS. (And insulate from any potential change on Android with Privacy Sandbox.) Retail media, a category we didn’t even talk about 3 years ago, is forecast to hit $142 billion this year.

Just to up the ante a little bit more, the United States is going through 1 of its most divisive elections yet. And that matters for mobile marketers, because total political advertising spending is expected to reach an unprecedented $10 to $12 billion, with at least a third of it on digital channels. That will push ad prices higher.

Through all this, however, app monetization is growing:

- Advertisers are spending over $1 billion each day in in-app ads

- In-app purchases should hit $213.36 billion for 2024

- In-app subscriptions are forecast to hit $120 billion for 2024

All of this means that user acquisition and customer acquisition is getting more and more competitive. Measurement is getting more complex, with more sets of differing numbers to reconcile. And the winners need the best technology and significant funding to break through the noise and optimize every ad dollar.

Welcome to Singular’s Q3 2024 quarterly report!

High-level: what changed in Q3

- iOS CPIs dropped, especially on games

- ATT opt-in rates jumped massively from Q2, with some gaming and app genres now at well over 20% opt-in

- Non-traditional ad networks grew the most in terms of new advertisers

- The most notable example: Perplexity, which gained the highest number of new advertisers of any ad network

- Others included Reddit, Taboola, Braze, along with the usual suspects like Google and Meta

- We also saw growth in non-traditional ad networks in terms of percentage spend increase

- Veritone: audio ads and more

- Roku: CTV ads

- Asia led in ad spend growth, especially in Japan, Korea, and Taiwan

- The US, UK, and Canada, meanwhile, lost ad spend

- Casual games continue to surge over Hyper Casual, especially on iOS

- CTRs increased on both Android and iOS

- IPMs increased for both Android and iOS

- Web share of spend is growing (and even more so, web’s share of clicks and conversions)

In addition, we have new insights from new data partners:

- Direct-to-device UA can insulate against holiday ad price spikes

- New device owners install as much as a third more apps

- Personalization boosts revenue 40%

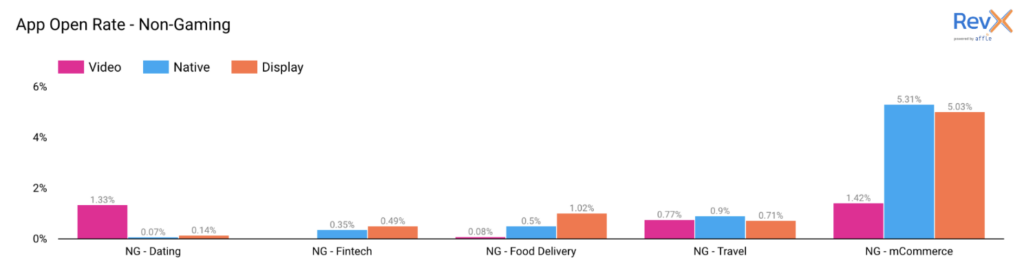

- Display ads often lead to the highest rates of actual app opens after install

- Video ads are critical for sports apps

- Native ads lead for retail apps

- Testing new Google Play keywords can have huge impact: up to 700% in 1 documented case

- Why iteration is better for finding creative winners than simple A/B testing

As always, data in this report is based on a significant slice of Singular’s data:

Global mobile at a glance

As of Q2 2024, here’s the state of the mobile world:

In-app spending is also growing in 2024, joining mobile advertising in providing huge monetization opportunities for mobile publishers.

Globally, 2.71 billion people are now shopping online, growing to 2.77 billion by 2025.

ATT opt-in rates

Overall ATT opt-in

After 2 down quarters, opt-in rates increased significantly in Q3 2024.

Last quarter the ATT YES rate dropped to 13.85%: a historically low opt-in rate. This quarter was very different: the yes rate jumped to 16.35%, which approaches Q3 2023’s high-water mark of 18.9%

Note: this is based on apps that ask for ATT permission immediately upon download. It’s important to remember that this rate can and does grow. Many apps do not request tracking permission immediately, so the percentage can grow over time.

ATT opt-in: gaming vs non-gaming

The gap between games and apps for initial ATT ask-and-accept is growing.

- In Q4 2023, the gap was just 1%

- In Q1 2024, the gap grew to 4.1%

- In Q2 2024, the gap expanded again to 6.67%

- In Q3 2024, the gap stayed basically level at 6.66%

Games are much more likely to get an immediate positive response to the ATT prompt, and this is increasingly true. 18.58% of games that asked for ATT permission upon download got a yes, while only 11.92% of apps did.

ATT opt-in by gaming verticals

ATT opt-in was up across the board in Q3 2024, and games are no exception. Adventure and Card games remain high, but Casual jumped from 22.57% to 25.52%.

Hyper casual, Family, and Trivia games are generally low performers.

Note: educational games for children cannot request tracking permission.

ATT opt-in by non-gaming verticals

Food & Drink remains high but is up almost 6 percentage points. Maps & Navigation is up from just over 25% to almost 33% while Health & Fitness actually drops a percentage point, moving opposite to the trend of increasing Yes anwers to the ATT prompt.

ATT double opt-in

App Tracking Transparency requires double opt-in: a yes on the publisher app that is displaying an ad, and a yes on the advertiser app that the ad is for. This is why you need a high ATT “yes” rate.

Note:

If you’re way above average and getting 40% on both sides, 16% of your installs are now trackable. That’s small, but at scale it’s a significant percentage which you can use as modeling guidance for your overall ad spend and optimization.

Even 10% could be enough, or 5% with sufficient volume.

Cost per install: global

Android games

- Global CPI: $0.65 ⬇️ $0.02

- Global CTR: 4.13% ⬆️ .79 percentage points

- Global IPM: 5.39 ⬆️ .8

For the second quarter in a row, global CPI for Android games is slightly down and CTR is up. But CTR jumped significantly this quarter, up almost a full percentage point.

Installs per thousand ad impressions was also up: almost 1 full install.

Casino games remain the most costly and are up slightly compared to last quarter, when they were $5.36 per install. Card, Board, and Strategy games continue to be among the most expensive installs you can get on Android, while Educational are the cheapest.

Android non-gaming

- Global CPI: $0.52 ⬆️ $0.02

- Global CTR: 2.74% ⬆️ .31 percentage points

- Global IPM: 4.68 ⬆️ .1

For Android apps, cost per install, click-through rate, and installs per thousand stayed almost the same from Q2 to Q3 2024.

Fintech is still near the top, but the currently leader in CPI is Sports apps, perhaps related to the Olympics in Paris. Food & Drink installs dropped by a dime, while Shopping apps dropped by almost 30 cents.

iOS games

- Global CPI: $2.67 ⬇️ $0.23

- Global CTR: 4.83% ⬆️ .56 percentage points

- Global IPM: 0.85 ⬆️ .17

CPI for iOS games is down slightly in Q3 2024.

More interestingly, however, look at how much more adblind iOS users are than Android users. Android IPMs for games are typically in the 4-5 range. iOS IPMs, on the other hand, are typically around 1 for games: a massive delta.

Card games took the top spot for CPI in Q3 2024 at $7.06, followed closely by Family and Casino games. Racing, Educational, Music, and Trivia games took the bottom 4 spots.

iOS non-gaming

- Global CPI: $0.69 ⬇️ $0.06

- Global CTR: 3.26% ⬆️ .25 percentage points

- Global IPM: 4.3 ⬆️ ..26

For the second quarter in a row, global iOS CPI dropped by exactly 6 cents. CTR jumped slightly, however, while IPM was also up about a quarter of an install per thousand ad views.

Sports apps jumped to the top of the CPI leaderboard, likely due to the Olympics in Paris this summer as well as, perhaps, the opening of the NFL and NHL seasons in North America. Fintech is always up there, but CPIs dropped in price just slightly.

Regional CPI, CTR, CVR: top countries

| Country | CPI | CTR | CVR |

|---|---|---|---|

| Afghanistan | $0.03 | 5.00% | 31.47% |

| Albania | $0.06 | 5.28% | 27.63% |

| Algeria | $0.01 | 5.50% | 34.72% |

| American Samoa | $0.17 | 2.35% | 29.52% |

| Andorra | $0.07 | 6.11% | 40.03% |

| Angola | $0.03 | 4.36% | 68.10% |

| Anguilla | $0.06 | 4.21% | 35.85% |

| Antarctica | $0.07 | 0.86% | 174.47% |

| Antigua and Barbuda | $0.07 | 4.34% | 38.68% |

| Argentina | $0.14 | 1.94% | 26.28% |

| Armenia | $0.04 | 5.74% | 34.41% |

| Aruba | $0.11 | 4.13% | 37.30% |

| Australia | $0.91 | 2.12% | 35.74% |

| Austria | $0.62 | 2.13% | 24.77% |

| Azerbaijan | $0.02 | 6.44% | 44.27% |

| Bahamas (the) | $0.11 | 4.87% | 36.12% |

| Bahrain | $0.09 | 4.57% | 35.15% |

| Bangladesh | $0.01 | 5.58% | 27.84% |

| Barbados | $0.05 | 5.25% | 38.56% |

| Belarus | $0.03 | 7.65% | 27.76% |

| Belgium | $0.51 | 2.24% | 27.84% |

| Belize | $0.04 | 5.19% | 39.66% |

| Benin | $0.04 | 4.08% | 55.52% |

| Bermuda | $0.19 | 2.95% | 34.54% |

| Bhutan | $0.03 | 3.15% | 32.21% |

| Bolivia (Plurinational State of) | $0.02 | 4.83% | 35.23% |

| Bonaire, Sint Eustatius and Saba | $0.08 | 3.82% | 36.54% |

| Bosnia and Herzegovina | $0.06 | 5.79% | 30.26% |

| Botswana | $0.05 | 4.01% | 52.90% |

| Brazil | $0.15 | 2.47% | 34.08% |

| British Indian Ocean Territory (the) | $0.08 | 2.76% | 59.61% |

| Brunei Darussalam | $0.05 | 6.44% | 26.42% |

| Bulgaria | $0.13 | 4.08% | 32.06% |

| Burkina Faso | $0.30 | 3.91% | 10.85% |

| Burundi | $0.04 | 4.77% | 35.44% |

| Cabo Verde | $0.03 | 3.16% | 45.38% |

| Cambodia | $0.04 | 4.24% | 28.97% |

| Cameroon | $0.04 | 3.34% | 59.57% |

| Canada | $1.10 | 2.16% | 29.45% |

| Cayman Islands (the) | $0.14 | 3.54% | 46.60% |

| Central African Republic (the) | $0.05 | 3.34% | 39.58% |

| Chad | $0.06 | 5.05% | 29.24% |

| Chile | $0.24 | 1.67% | 31.59% |

| China | $0.01 | 150.15% | 20.82% |

| Colombia | $0.12 | 2.17% | 34.58% |

| Comoros (the) | $0.04 | 3.42% | 40.29% |

| Congo (the Democratic Republic of the) | $0.04 | 5.14% | 31.23% |

| Congo (the) | $0.03 | 4.21% | 55.02% |

| Cook Islands (the) | $0.17 | 3.89% | 22.85% |

| Costa Rica | $0.08 | 2.78% | 45.46% |

| Croatia | $0.15 | 3.88% | 33.39% |

| Curaçao | $0.06 | 5.00% | 34.62% |

| Cyprus | $0.16 | 3.53% | 36.62% |

| Czechia | $0.25 | 2.59% | 27.11% |

| Côte d’Ivoire | $0.02 | 3.95% | 77.23% |

| Denmark | $0.95 | 1.81% | 16.69% |

| Djibouti | $0.03 | 6.16% | 35.08% |

| Dominica | $0.04 | 5.13% | 39.99% |

| Dominican Republic (the) | $0.05 | 4.46% | 34.85% |

| Ecuador | $0.05 | 3.62% | 41.79% |

| Egypt | $0.03 | 4.57% | 45.02% |

| El Salvador | $0.05 | 4.08% | 42.00% |

| Equatorial Guinea | $0.03 | 4.86% | 33.83% |

| Eritrea | $0.02 | 3.83% | 140.44% |

| Estonia | $0.14 | 2.70% | 34.78% |

| Eswatini | $0.06 | 4.17% | 36.77% |

| Ethiopia | $0.06 | 4.09% | 31.20% |

| Falkland Islands (the) [Malvinas] | $0.11 | 2.69% | 35.51% |

| Faroe Islands (the) | $0.17 | 3.49% | 24.32% |

| Fiji | $0.08 | 3.86% | 35.33% |

| Finland | $0.63 | 1.25% | 30.44% |

| France | $0.85 | 1.58% | 22.87% |

| French Guiana | $0.07 | 2.90% | 52.14% |

| French Polynesia | $0.08 | 5.19% | 34.22% |

| French Southern Territories (the) | $0.11 | 0.72% | 83.33% |

| Gabon | $0.02 | 4.34% | 63.02% |

| Gambia (the) | $0.04 | 4.89% | 37.35% |

| Georgia | $0.07 | 5.40% | 29.26% |

| Germany | $0.92 | 1.94% | 25.84% |

| Ghana | $0.09 | 4.44% | 26.07% |

| Gibraltar | $0.12 | 3.77% | 41.01% |

| Greece | $0.23 | 2.35% | 24.74% |

| Greenland | $0.15 | 1.92% | 29.11% |

| Grenada | $0.05 | 4.74% | 37.38% |

| Guadeloupe | $0.11 | 1.35% | 45.54% |

| Guam | $0.24 | 3.93% | 20.88% |

| Guatemala | $0.05 | 4.21% | 39.88% |

| Guernsey | $0.17 | 4.09% | 32.62% |

| Guinea | $0.03 | 3.49% | 50.06% |

| Guinea-Bissau | $0.04 | 4.38% | 39.17% |

| Guyana | $0.03 | 5.40% | 38.47% |

| Haiti | $0.02 | 4.54% | 50.73% |

| Holy See (the) | $0.18 | 4.28% | 91.75% |

| Honduras | $0.04 | 4.65% | 39.23% |

| Hong Kong | $0.23 | 2.29% | 69.64% |

| Hungary | $0.21 | 3.01% | 25.64% |

| Iceland | $0.26 | 3.09% | 27.19% |

| India | $0.09 | 2.46% | 24.46% |

| Indonesia | $0.05 | 3.45% | 29.48% |

| Iran (Islamic Republic of) | $0.00 | 6.26% | 84.37% |

| Iraq | $0.01 | 11.03% | 25.77% |

| Ireland | $0.58 | 1.93% | 26.93% |

| Isle of Man | $0.14 | 4.71% | 29.39% |

| Israel | $0.19 | 4.57% | 32.01% |

| Italy | $0.50 | 2.03% | 21.03% |

| Jamaica | $0.07 | 4.77% | 37.09% |

| Japan | $0.17 | 2.17% | 74.69% |

| Jersey | $0.16 | 4.45% | 35.26% |

| Jordan | $0.23 | 4.19% | 30.46% |

| Kazakhstan | $0.03 | 5.63% | 38.95% |

| Kenya | $0.06 | 2.21% | 54.79% |

| Kiribati | $0.25 | 1.97% | 15.14% |

| Korea (the Democratic People’s Republic of) | 4.76% | 69.70% | |

| Korea (the Republic of) | $0.45 | 2.59% | 23.63% |

| Kuwait | $0.16 | 2.99% | 28.59% |

| Kyrgyzstan | $0.01 | 9.14% | 38.87% |

| Lao People’s Democratic Republic (the) | $0.01 | 6.33% | 37.86% |

| Latvia | $0.12 | 4.78% | 26.75% |

| Lebanon | $0.03 | 6.32% | 25.08% |

| Lesotho | $0.05 | 3.40% | 44.15% |

| Liberia | $0.06 | 3.74% | 39.77% |

| Libya | $0.02 | 5.40% | 32.20% |

| Liechtenstein | $0.19 | 2.57% | 36.37% |

| Lithuania | $0.12 | 4.03% | 31.72% |

| Luxembourg | $0.28 | 2.76% | 23.04% |

| Macao | $0.21 | 5.31% | 26.32% |

| Madagascar | $0.04 | 4.14% | 48.52% |

| Malawi | $0.04 | 4.74% | 36.85% |

| Malaysia | $0.17 | 2.48% | 18.65% |

| Maldives | $0.04 | 5.10% | 30.38% |

| Mali | $0.06 | 6.43% | 21.59% |

| Malta | $0.16 | 3.58% | 37.34% |

| Marshall Islands (the) | $0.07 | 2.87% | 32.49% |

| Martinique | $0.11 | 3.01% | 35.65% |

| Mauritania | $0.03 | 5.03% | 46.12% |

| Mauritius | $0.08 | 3.50% | 35.86% |

| Mayotte | $0.07 | 2.97% | 43.07% |

| Mexico | $0.34 | 1.58% | 22.83% |

| Micronesia (Federated States of) | $0.05 | 4.25% | 28.08% |

| Moldova (the Republic of) | $0.04 | 5.94% | 36.56% |

| Monaco | $0.24 | 7.01% | 49.03% |

| Mongolia | $0.04 | 5.00% | 33.71% |

| Montenegro | $0.06 | 5.75% | 30.26% |

| Montserrat | $0.08 | 3.13% | 35.03% |

| Morocco | $0.05 | 6.10% | 29.38% |

| Mozambique | $0.04 | 4.79% | 56.08% |

| Myanmar | $0.02 | 5.25% | 35.06% |

| Namibia | $0.29 | 4.80% | 64.85% |

| Nauru | $0.50 | 1.68% | 14.05% |

| Nepal | $0.02 | 4.94% | 22.46% |

| Netherlands (the) | $0.88 | 2.86% | 19.18% |

| New Caledonia | $0.08 | 4.15% | 29.62% |

| New Zealand | $0.82 | 2.02% | 32.20% |

| Nicaragua | $0.03 | 5.46% | 37.05% |

| Niger (the) | $0.02 | 5.28% | 49.29% |

| Nigeria | $0.11 | 1.33% | 42.30% |

| Niue | $3.00 | 1.54% | 4.57% |

| Norfolk Island | $0.32 | 1.67% | 26.31% |

| Northern Mariana Islands (the) | $0.08 | 3.63% | 39.40% |

| Norway | $0.64 | 1.48% | 23.33% |

| Oman | $0.06 | 4.37% | 37.00% |

| Pakistan | $0.03 | 4.69% | 25.43% |

| Palau | $0.10 | 3.61% | 26.74% |

| Palestine, State of | $0.02 | 7.46% | 31.01% |

| Panama | $0.05 | 4.32% | 43.60% |

| Papua New Guinea | $0.12 | 3.78% | 29.27% |

| Paraguay | $0.03 | 4.92% | 41.96% |

| Peru | $0.16 | 2.17% | 33.97% |

| Philippines (the) | $0.09 | 2.71% | 24.37% |

| Pitcairn | $0.02 | 2.32% | 106.12% |

| Poland | $0.25 | 2.26% | 34.32% |

| Portugal | $0.37 | 1.82% | 28.70% |

| Puerto Rico | $0.20 | 3.53% | 27.41% |

| Qatar | $0.12 | 3.19% | 37.70% |

| Republic of North Macedonia | $0.04 | 6.90% | 26.40% |

| Romania | $0.15 | 2.98% | 33.43% |

| Russian Federation (the) | $0.05 | 9.45% | 27.51% |

| Rwanda | $0.05 | 5.35% | 34.59% |

| Réunion | $0.08 | 3.56% | 39.62% |

| Saint Barthélemy | $0.46 | 1.38% | 18.90% |

| Saint Helena, Ascension and Tristan da Cunha | $0.02 | 2.74% | 96.27% |

| Saint Kitts and Nevis | $0.07 | 4.37% | 33.48% |

| Saint Lucia | $0.05 | 5.31% | 41.17% |

| Saint Martin (French part) | $0.22 | 2.04% | 18.70% |

| Saint Pierre and Miquelon | $0.15 | 1.41% | 30.27% |

| Saint Vincent and the Grenadines | $0.04 | 5.14% | 37.30% |

| Samoa | $0.04 | 4.08% | 26.02% |

| San Marino | $0.11 | 4.40% | 31.59% |

| Sao Tome and Principe | $0.03 | 4.07% | 45.73% |

| Saudi Arabia | $0.14 | 2.93% | 37.25% |

| Senegal | $0.02 | 4.98% | 61.83% |

| Serbia | $0.07 | 5.11% | 26.92% |

| Seychelles | $0.02 | 5.51% | 81.61% |

| Sierra Leone | $0.04 | 4.76% | 39.93% |

| Singapore | $0.25 | 3.33% | 48.81% |

| Sint Maarten (Dutch part) | $0.09 | 3.35% | 32.04% |

| Slovakia | $0.17 | 2.86% | 30.26% |

| Slovenia | $0.20 | 3.43% | 31.73% |

| Solomon Islands | $0.08 | 4.53% | 20.41% |

| Somalia | $0.02 | 5.99% | 40.86% |

| South Africa | $0.22 | 2.04% | 28.54% |

| South Sudan | $0.06 | 3.68% | 34.09% |

| Spain | $0.54 | 1.79% | 21.83% |

| Sri Lanka | $0.04 | 2.58% | 44.10% |

| Sudan (the) | $0.01 | 4.62% | 56.96% |

| Suriname | $0.02 | 6.54% | 33.97% |

| Svalbard and Jan Mayen | $2.17 | 0.92% | 7.53% |

| Sweden | $0.51 | 2.61% | 20.11% |

| Switzerland | $0.76 | 2.36% | 25.01% |

| Syrian Arab Republic | $0.00 | 8.49% | 433.00% |

| Taiwan (Province of China) | $0.66 | 1.91% | 17.06% |

| Tajikistan | $0.01 | 9.84% | 35.82% |

| Tanzania, United Republic of | $0.07 | 2.42% | 44.99% |

| Thailand | $0.17 | 2.94% | 22.85% |

| Timor-Leste | $0.03 | 4.19% | 36.98% |

| Togo | $0.02 | 4.68% | 57.91% |

| Tokelau | $0.05 | 2.39% | 70.00% |

| Tonga | $0.11 | 2.54% | 28.32% |

| Trinidad and Tobago | $0.04 | 6.43% | 34.09% |

| Tunisia | $0.02 | 4.59% | 45.56% |

| Turkey | $0.08 | 2.86% | 30.50% |

| Turkmenistan | $0.00 | 6.60% | 114.81% |

| Turks and Caicos Islands (the) | $0.12 | 2.68% | 41.50% |

| Tuvalu | $0.55 | 0.75% | 18.76% |

| Uganda | $0.03 | 3.92% | 55.76% |

| Ukraine | $0.05 | 6.19% | 27.92% |

| United Arab Emirates (the) | $0.23 | 2.92% | 37.20% |

| United Kingdom of Great Britain and Northern Ireland (the) | $0.89 | 1.80% | 34.33% |

| United States of America (the) | $1.64 | 1.87% | 30.13% |

| Uruguay | $0.07 | 3.44% | 41.97% |

| Uzbekistan | $0.01 | 8.23% | 45.48% |

| Vanuatu | $0.09 | 7.95% | 10.21% |

| Venezuela (Bolivarian Republic of) | $0.02 | 5.00% | 31.46% |

| Viet Nam | $0.04 | 5.09% | 31.06% |

| Virgin Islands (British) | $0.15 | 2.70% | 31.12% |

| Virgin Islands (U.S.) | $0.16 | 3.17% | 33.11% |

| Wallis and Futuna | $0.09 | 2.83% | 18.82% |

| Yemen | $0.02 | 6.78% | 28.35% |

| Zambia | $0.03 | 3.95% | 56.28% |

| Zimbabwe | $0.04 | 3.83% | 63.88% |

| Åland Islands | $0.03 | 7.18% | 37.51% |

Ad networks & platforms: top gainers

Gained the most ad spend

It’s always challenging to list ad network growth by percentage. Singular works with literally thousands of platforms, and so some tiny networks with almost no spend can zoom to the top by having a good quarter.

So we’re dividing this list into 2 parts: absolute growth leaders and large platform leaders. Note that size here is not about the platform itself: it’s about spend on the platform by Singular clients.

Absolute leaders in Q2 to Q3 ad spend growth

- Blisspoint

- Snapchat

- TikTok Ads

- Almedia

- theTradeDesk

- adjoe

- Amazon Media Group

- Veritone

- X

- Mintegral International Limited

- Exmox

- FluentCo

- Gamelight

Growth leaders in Q2 to Q3 spend: percentage growth

- Veritone

- theTradeDesk

- Roku

- Line Ads Platform

- Ocean Media

- Tyrads

- Gamelight

- Almedia

- Amazon Media Group

Gained the most advertisers

These ad networks gained the most new advertisers from Q2 to Q3:

- Perplexity

- Mintegral International Limited

- Liftoff

- Taboola

- Checkmate

- AppLovin

- Unity Ads

- MOLOCO

- Trustpilot

- Braze

- Munimob

Ad spend growth and decrease by country

Q3 was a basically flat quarter for ad spend globally. But, of course, some countries gained ad spend, and some lost.

Here are the top ad spend gainers, listed by absolute dollars spent increase:

- Japan

- Korea

- Taiwan

- Vietnam

- Phillippines

- Indonesia

- Hong Kong

- Thailand

- Malaysia

- Singapore

- New Zealand

- Sri Lanka

- Pakistan

- Bangladesh

- Saudi Arabia

And here are the countries that lost the most ad spend. Most of the decreases were in the low single digit percentages.

- United States

- UK

- Canada

- Brazil

- India

- France

- Germany

- Mexico

- Australia

- Argentina

- South Africa

- Italy

- Spain

- Netherlands

- Belgium

Hottest genres with the most downloads: global

Android games

Casual games held their ground in Q3 at 25% of all game installs on Android. But, surprisingly, Hyper Casual rebounded slightly in Q3 to surge just slightly ahead:

- Q4 2023: 36%

- Q1 2024: 21%

- Q2 2024: 24%

- Q3 2024: 26%

Is better measurement from MMPs like Singular, with Unified Measurement, as well as platform probabilistic like AEM from Meta reversing some of the trends that were driving Hyper Casual down?

Possibly. But in addition, publishers are getting smarter and more diversified in monetization.

Android non-gaming

The big 5 categories of Entertainment, Lifestyle, Social, Business, and Travel take up about 60% of all app installs outside of games on Android.

iOS games

We’re seeing the same shift in iOS as we did on Android: growth of the Casual gaming genre at the expense of the Hyper Casual category.

In Q2 Casual surpassed Hyper Casual on iOS; in Q3 Casual extended that lead with almost 30% more installs than Hyper Casual.

iOS: non-gaming

Music & Audio keeps the lead in iOS apps for a second straight quarter, and the big 5 categories on iOS are even more dominant than the big 5 on Android with a full 66% of all app installs.

Those 5 categories:

- Music & Audio

- Lifestyle

- Entertainment

- Travel

- Social

Key metrics by vertical

Click-through rates: games

For Q3 2024, CTR increased across the board for both Android and iOS games and apps.

Average CTR for Android games hit 4.13%, with Racing in the lead, followed by Hyper Casual and Adventure games.

On iOS, average CTR for games was slightly higher than Android at 4.83%. Racing games led, followed by Puzzle and Educational games.

Click-through rates: apps

As mentioned above, overall CTRs for apps as well as games were up in Q3 on both Android and iOS.

Overall CTR for Android apps was 2.41%.

Photo & Video had the highest CTR, as it did in Q2, followed by Social, Art & Design, and Entertainment.

On iOS, the CTR across all apps was 3.26%, significantly higher than on Android.

High-performing verticals include Books & Reference and Photo & Video, both over 10%, while Entertainment is at 5.44%. Social is just under 2%, while Travel is just .72%.

IPM: games

Across the board, IPM (installs per thousand ad views) was up for both Android and iOS games and apps.

Average IPM for Android games was 5.39 in Q3, with Music and Racing by far in the lead at almost 29 and 25, respectively. Genres with the lowest IPM in Android games are Casino and Strategy games.

Average IPM on iOS for games is much lower than on Android, and that’s been consistently true for 4 quarters in a row. In Q3, it hit .85, compared to 5.39 on Android.

Hyper Casual leads at just over 4, while Family games are lowest at just .27 installs per thousand ad views.

IPM: apps

As mentioned above, IPM for apps and games on both the iOS and Android platforms was up in Q3. Android apps had an average IPM of 4.68.

Health & Fitness jumped 10 installs per thousand ad views from Q2, landing at over 35 in Q3, while Medical, Art & Design, Productivity, and Business apps all led as well.

Average IPM for iOS apps is 4.3, which has been relatively steady for the past 4 quarters.

There are some massive outliers with over 100, indicating 1 install per every 10 ad views. This is extremely unlikely to be accurate, and we’re checking the data to see what might be happening here.

Platform ad spend share: iOS, Android, web

iOS is growing, at least for Singular clients, in Q3 2024. For the quarter the ad spend split was 40.12% iOS, 36.47% Android, and 23.42% web.

Essentially, that’s a return to normal for iOS, which was down below 39% of ad spend in Q2.

But there’s a little more to the story for web. The numbers in the chart above are quarterly numbers. If we look a little closer at monthly numbers, we see a clear pattern that is related to the growing web-to-app trend.

Simply put: web is growing.

And in fact that growth is likely to be under-reported, because this is a comparison of ad spend, not clicks or conversions. Web ad spend is often cheaper than mobile. We’ll be diving deeper into this in future Quarterly Trend Reports.

Platform spend by country

| Country | Platform | % of Total Cost |

|---|---|---|

| Aruba | iOS | 37.75% |

| Android | 60.51% | |

| Desktop & Web | 1.74% | |

| Afghanistan | iOS | 29.54% |

| Android | 67.22% | |

| Desktop & Web | 3.24% | |

| Angola | iOS | 32.18% |

| Android | 58.12% | |

| Desktop & Web | 9.70% | |

| Anguilla | iOS | 31.27% |

| Android | 66.29% | |

| Desktop & Web | 2.44% | |

| Åland Islands | iOS | 65.11% |

| Android | 34.89% | |

| Desktop & Web | 0.00% | |

| Albania | iOS | 50.76% |

| Android | 34.79% | |

| Desktop & Web | 14.46% | |

| Andorra | iOS | 78.59% |

| Android | 15.23% | |

| Desktop & Web | 6.18% | |

| United Arab Emirates (the) | iOS | 42.22% |

| Android | 41.39% | |

| Desktop & Web | 16.39% | |

| Argentina | iOS | 13.55% |

| Android | 66.58% | |

| Desktop & Web | 19.87% | |

| Armenia | iOS | 43.58% |

| Android | 49.46% | |

| Desktop & Web | 6.95% | |

| American Samoa | iOS | 61.11% |

| Android | 32.83% | |

| Desktop & Web | 6.06% | |

| Antarctica | iOS | 36.87% |

| Android | 56.05% | |

| Desktop & Web | 7.09% | |

| French Southern Territories (the) | iOS | 41.73% |

| Android | 58.27% | |

| Desktop & Web | ||

| Antigua and Barbuda | iOS | 25.50% |

| Android | 73.12% | |

| Desktop & Web | 1.38% | |

| Australia | iOS | 38.91% |

| Android | 33.65% | |

| Desktop & Web | 27.44% | |

| Austria | iOS | 33.83% |

| Android | 53.24% | |

| Desktop & Web | 12.93% | |

| Azerbaijan | iOS | 29.30% |

| Android | 66.24% | |

| Desktop & Web | 4.46% | |

| Burundi | iOS | 25.60% |

| Android | 66.36% | |

| Desktop & Web | 8.05% | |

| Belgium | iOS | 30.66% |

| Android | 51.53% | |

| Desktop & Web | 17.81% | |

| Benin | iOS | 20.32% |

| Android | 61.78% | |

| Desktop & Web | 17.90% | |

| Bonaire, Sint Eustatius and Saba | iOS | 38.89% |

| Android | 59.07% | |

| Desktop & Web | 2.04% | |

| Burkina Faso | iOS | 3.33% |

| Android | 19.38% | |

| Desktop & Web | 77.29% | |

| Bangladesh | iOS | 9.59% |

| Android | 67.58% | |

| Desktop & Web | 22.83% | |

| Bulgaria | iOS | 26.82% |

| Android | 58.72% | |

| Desktop & Web | 14.46% | |

| Bahrain | iOS | 47.98% |

| Android | 44.91% | |

| Desktop & Web | 7.11% | |

| Bahamas (the) | iOS | 34.27% |

| Android | 64.54% | |

| Desktop & Web | 1.19% | |

| Bosnia and Herzegovina | iOS | 31.58% |

| Android | 64.13% | |

| Desktop & Web | 4.29% | |

| Saint Barthélemy | iOS | 47.17% |

| Android | 42.00% | |

| Desktop & Web | 10.83% | |

| Belarus | iOS | 21.69% |

| Android | 76.86% | |

| Desktop & Web | 1.45% | |

| Belize | iOS | 12.21% |

| Android | 86.65% | |

| Desktop & Web | 1.14% | |

| Bermuda | iOS | 63.72% |

| Android | 33.43% | |

| Desktop & Web | 2.85% | |

| Bolivia (Plurinational State of) | iOS | 12.30% |

| Android | 81.24% | |

| Desktop & Web | 6.46% | |

| Brazil | iOS | 18.64% |

| Android | 60.10% | |

| Desktop & Web | 21.26% | |

| Barbados | iOS | 23.54% |

| Android | 74.73% | |

| Desktop & Web | 1.73% | |

| Brunei Darussalam | iOS | 50.74% |

| Android | 40.54% | |

| Desktop & Web | 8.71% | |

| Bhutan | iOS | 37.44% |

| Android | 54.66% | |

| Desktop & Web | 7.91% | |

| Bouvet Island | Android | |

| Botswana | iOS | 18.09% |

| Android | 73.40% | |

| Desktop & Web | 8.51% | |

| Central African Republic (the) | iOS | 23.96% |

| Android | 68.69% | |

| Desktop & Web | 7.35% | |

| Canada | iOS | 42.09% |

| Android | 35.08% | |

| Desktop & Web | 22.83% | |

| Cocos (Keeling) Islands (the) | iOS | 54.09% |

| Android | 45.91% | |

| Desktop & Web | ||

| Switzerland | iOS | 42.05% |

| Android | 41.68% | |

| Desktop & Web | 16.27% | |

| Chile | iOS | 16.78% |

| Android | 56.38% | |

| Desktop & Web | 26.84% | |

| China | iOS | 82.22% |

| Android | 4.03% | |

| Desktop & Web | 13.75% | |

| Côte d’Ivoire | iOS | 39.29% |

| Android | 50.96% | |

| Desktop & Web | 9.74% | |

| Cameroon | iOS | 11.45% |

| Android | 72.94% | |

| Desktop & Web | 15.61% | |

| Congo (the Democratic Republic of the) | iOS | 31.25% |

| Android | 61.78% | |

| Desktop & Web | 6.97% | |

| Congo (the) | iOS | 44.54% |

| Android | 46.92% | |

| Desktop & Web | 8.54% | |

| Cook Islands (the) | iOS | 45.79% |

| Android | 41.33% | |

| Desktop & Web | 12.87% | |

| Colombia | iOS | 19.59% |

| Android | 61.84% | |

| Desktop & Web | 18.57% | |

| Comoros (the) | iOS | 23.41% |

| Android | 64.48% | |

| Desktop & Web | 12.11% | |

| Cabo Verde | iOS | 51.73% |

| Android | 44.17% | |

| Desktop & Web | 4.10% | |

| Costa Rica | iOS | 15.95% |

| Android | 78.21% | |

| Desktop & Web | 5.84% | |

| Cuba | iOS | 8.97% |

| Android | 91.00% | |

| Desktop & Web | 0.04% | |

| Curaçao | iOS | 26.25% |

| Android | 72.31% | |

| Desktop & Web | 1.44% | |

| Christmas Island | iOS | 0.60% |

| Android | 17.04% | |

| Desktop & Web | 82.37% | |

| Cayman Islands (the) | iOS | 44.98% |

| Android | 51.33% | |

| Desktop & Web | 3.69% | |

| Cyprus | iOS | 37.47% |

| Android | 50.52% | |

| Desktop & Web | 12.01% | |

| Czechia | iOS | 23.93% |

| Android | 61.52% | |

| Desktop & Web | 14.56% | |

| Germany | iOS | 31.34% |

| Android | 48.40% | |

| Desktop & Web | 20.26% | |

| Djibouti | iOS | 19.32% |

| Android | 63.97% | |

| Desktop & Web | 16.72% | |

| Dominica | iOS | 14.34% |

| Android | 84.08% | |

| Desktop & Web | 1.58% | |

| Denmark | iOS | 40.42% |

| Android | 23.45% | |

| Desktop & Web | 36.12% | |

| Dominican Republic (the) | iOS | 11.47% |

| Android | 86.56% | |

| Desktop & Web | 1.96% | |

| Algeria | iOS | 10.63% |

| Android | 66.41% | |

| Desktop & Web | 22.96% | |

| Ecuador | iOS | 21.83% |

| Android | 66.92% | |

| Desktop & Web | 11.25% | |

| Egypt | iOS | 20.47% |

| Android | 62.48% | |

| Desktop & Web | 17.06% | |

| Eritrea | iOS | 14.22% |

| Android | 43.63% | |

| Desktop & Web | 42.16% | |

| Western Sahara | iOS | 15.81% |

| Android | 51.21% | |

| Desktop & Web | 32.98% | |

| Spain | iOS | 23.89% |

| Android | 46.22% | |

| Desktop & Web | 29.89% | |

| Estonia | iOS | 29.53% |

| Android | 60.11% | |

| Desktop & Web | 10.36% | |

| Ethiopia | iOS | 6.97% |

| Android | 62.11% | |

| Desktop & Web | 30.92% | |

| Finland | iOS | 21.26% |

| Android | 38.19% | |

| Desktop & Web | 40.55% | |

| Fiji | iOS | 20.43% |

| Android | 60.19% | |

| Desktop & Web | 19.38% | |

| Falkland Islands (the) [Malvinas] | iOS | 43.62% |

| Android | 51.66% | |

| Desktop & Web | 4.72% | |

| France | iOS | 34.07% |

| Android | 41.41% | |

| Desktop & Web | 24.52% | |

| Faroe Islands (the) | iOS | 65.61% |

| Android | 30.74% | |

| Desktop & Web | 3.66% | |

| Micronesia (Federated States of) | iOS | 39.72% |

| Android | 59.30% | |

| Desktop & Web | 0.99% | |

| Gabon | iOS | 26.03% |

| Android | 66.31% | |

| Desktop & Web | 7.67% | |

| United Kingdom of Great Britain and Northern Ireland (the) | iOS | 39.77% |

| Android | 36.82% | |

| Desktop & Web | 23.41% | |

| Georgia | iOS | 41.13% |

| Android | 52.55% | |

| Desktop & Web | 6.32% | |

| Guernsey | iOS | 72.03% |

| Android | 23.71% | |

| Desktop & Web | 4.26% | |

| Ghana | iOS | 17.77% |

| Android | 42.59% | |

| Desktop & Web | 39.64% | |

| Gibraltar | iOS | 67.14% |

| Android | 25.98% | |

| Desktop & Web | 6.87% | |

| Guinea | iOS | 33.79% |

| Android | 58.45% | |

| Desktop & Web | 7.76% | |

| Guadeloupe | iOS | 26.05% |

| Android | 64.04% | |

| Desktop & Web | 9.92% | |

| Gambia (the) | iOS | 42.33% |

| Android | 48.02% | |

| Desktop & Web | 9.65% | |

| Guinea-Bissau | iOS | 23.31% |

| Android | 74.31% | |

| Desktop & Web | 2.38% | |

| Equatorial Guinea | iOS | 62.51% |

| Android | 35.26% | |

| Desktop & Web | 2.23% | |

| Greece | iOS | 29.29% |

| Android | 50.77% | |

| Desktop & Web | 19.94% | |

| Grenada | iOS | 18.88% |

| Android | 78.62% | |

| Desktop & Web | 2.50% | |

| Greenland | iOS | 43.33% |

| Android | 54.33% | |

| Desktop & Web | 2.33% | |

| Guatemala | iOS | 5.21% |

| Android | 90.49% | |

| Desktop & Web | 4.30% | |

| French Guiana | iOS | 42.73% |

| Android | 43.89% | |

| Desktop & Web | 13.38% | |

| Guam | iOS | 56.95% |

| Android | 41.83% | |

| Desktop & Web | 1.22% | |

| Guyana | iOS | 36.25% |

| Android | 59.52% | |

| Desktop & Web | 4.23% | |

| Hong Kong | iOS | 56.45% |

| Android | 34.75% | |

| Desktop & Web | 8.80% | |

| Heard Island and McDonald Islands | iOS | |

| Android | ||

| Honduras | iOS | 8.67% |

| Android | 90.28% | |

| Desktop & Web | 1.04% | |

| Croatia | iOS | 22.36% |

| Android | 70.72% | |

| Desktop & Web | 6.92% | |

| Haiti | iOS | 2.10% |

| Android | 97.05% | |

| Desktop & Web | 0.84% | |

| Hungary | iOS | 23.35% |

| Android | 58.50% | |

| Desktop & Web | 18.15% | |

| Indonesia | iOS | 17.03% |

| Android | 80.08% | |

| Desktop & Web | 2.89% | |

| Isle of Man | iOS | 66.38% |

| Android | 29.68% | |

| Desktop & Web | 3.94% | |

| India | iOS | 15.15% |

| Android | 67.74% | |

| Desktop & Web | 17.11% | |

| British Indian Ocean Territory (the) | iOS | 22.14% |

| Android | 75.21% | |

| Desktop & Web | 2.65% | |

| Ireland | iOS | 24.82% |

| Android | 43.80% | |

| Desktop & Web | 31.38% | |

| Iran (Islamic Republic of) | iOS | 23.77% |

| Android | 76.07% | |

| Desktop & Web | 0.16% | |

| Iraq | iOS | 39.60% |

| Android | 55.83% | |

| Desktop & Web | 4.57% | |

| Iceland | iOS | 47.01% |

| Android | 44.96% | |

| Desktop & Web | 8.03% | |

| Israel | iOS | 46.41% |

| Android | 39.22% | |

| Desktop & Web | 14.37% | |

| Italy | iOS | 31.87% |

| Android | 47.76% | |

| Desktop & Web | 20.37% | |

| Jamaica | iOS | 12.05% |

| Android | 85.64% | |

| Desktop & Web | 2.31% | |

| Jersey | iOS | 31.76% |

| Android | 12.97% | |

| Desktop & Web | 55.27% | |

| Jordan | iOS | 21.74% |

| Android | 23.48% | |

| Desktop & Web | 54.78% | |

| Japan | iOS | 50.50% |

| Android | 38.86% | |

| Desktop & Web | 10.64% | |

| Kazakhstan | iOS | 31.32% |

| Android | 66.92% | |

| Desktop & Web | 1.76% | |

| Kenya | iOS | 7.36% |

| Android | 71.81% | |

| Desktop & Web | 20.83% | |

| Kyrgyzstan | iOS | 24.09% |

| Android | 74.49% | |

| Desktop & Web | 1.42% | |

| Cambodia | iOS | 50.21% |

| Android | 46.10% | |

| Desktop & Web | 3.69% | |

| Kiribati | iOS | 12.61% |

| Android | 65.68% | |

| Desktop & Web | 21.71% | |

| Saint Kitts and Nevis | iOS | 27.08% |

| Android | 71.55% | |

| Desktop & Web | 1.37% | |

| Korea (the Republic of) | iOS | 23.06% |

| Android | 71.57% | |

| Desktop & Web | 5.37% | |

| Kuwait | iOS | 61.42% |

| Android | 28.49% | |

| Desktop & Web | 10.09% | |

| Lao People’s Democratic Republic (the) | iOS | 45.14% |

| Android | 50.59% | |

| Desktop & Web | 4.27% | |

| Lebanon | iOS | 41.76% |

| Android | 48.76% | |

| Desktop & Web | 9.48% | |

| Liberia | iOS | 34.00% |

| Android | 55.90% | |

| Desktop & Web | 10.10% | |

| Libya | iOS | 45.80% |

| Android | 49.90% | |

| Desktop & Web | 4.30% | |

| Saint Lucia | iOS | 13.99% |

| Android | 84.57% | |

| Desktop & Web | 1.45% | |

| Liechtenstein | iOS | 51.16% |

| Android | 32.91% | |

| Desktop & Web | 15.94% | |

| Sri Lanka | iOS | 24.52% |

| Android | 58.90% | |

| Desktop & Web | 16.58% | |

| Lesotho | iOS | 14.29% |

| Android | 45.91% | |

| Desktop & Web | 39.80% | |

| Lithuania | iOS | 30.38% |

| Android | 62.97% | |

| Desktop & Web | 6.64% | |

| Luxembourg | iOS | 46.85% |

| Android | 35.52% | |

| Desktop & Web | 17.63% | |

| Latvia | iOS | 26.85% |

| Android | 63.56% | |

| Desktop & Web | 9.59% | |

| Macao | iOS | 82.74% |

| Android | 15.51% | |

| Desktop & Web | 1.76% | |

| Saint Martin (French part) | iOS | 37.59% |

| Android | 60.27% | |

| Desktop & Web | 2.14% | |

| Morocco | iOS | 14.94% |

| Android | 53.54% | |

| Desktop & Web | 31.51% | |

| Monaco | iOS | 79.34% |

| Android | 13.28% | |

| Desktop & Web | 7.37% | |

| Moldova (the Republic of) | iOS | 26.52% |

| Android | 68.40% | |

| Desktop & Web | 5.08% | |

| Madagascar | iOS | 20.74% |

| Android | 54.60% | |

| Desktop & Web | 24.66% | |

| Maldives | iOS | 42.64% |

| Android | 50.54% | |

| Desktop & Web | 6.82% | |

| Mexico | iOS | 17.62% |

| Android | 61.92% | |

| Desktop & Web | 20.46% | |

| Marshall Islands (the) | iOS | 45.08% |

| Android | 53.90% | |

| Desktop & Web | 1.02% | |

| Republic of North Macedonia | iOS | 46.95% |

| Android | 47.23% | |

| Desktop & Web | 5.81% | |

| Mali | iOS | 19.00% |

| Android | 41.42% | |

| Desktop & Web | 39.58% | |

| Malta | iOS | 45.23% |

| Android | 48.47% | |

| Desktop & Web | 6.31% | |

| Myanmar | iOS | 22.95% |

| Android | 57.48% | |

| Desktop & Web | 19.56% | |

| Montenegro | iOS | 57.49% |

| Android | 37.75% | |

| Desktop & Web | 4.76% | |

| Mongolia | iOS | 61.71% |

| Android | 31.42% | |

| Desktop & Web | 6.87% | |

| Northern Mariana Islands (the) | iOS | 55.25% |

| Android | 42.88% | |

| Desktop & Web | 1.87% | |

| Mozambique | iOS | 18.74% |

| Android | 72.68% | |

| Desktop & Web | 8.58% | |

| Mauritania | iOS | 43.60% |

| Android | 52.76% | |

| Desktop & Web | 3.65% | |

| Montserrat | iOS | 23.56% |

| Android | 73.09% | |

| Desktop & Web | 3.35% | |

| Martinique | iOS | 23.05% |

| Android | 69.64% | |

| Desktop & Web | 7.31% | |

| Mauritius | iOS | 29.33% |

| Android | 64.60% | |

| Desktop & Web | 6.07% | |

| Malawi | iOS | 15.35% |

| Android | 73.91% | |

| Desktop & Web | 10.73% | |

| Malaysia | iOS | 36.22% |

| Android | 60.02% | |

| Desktop & Web | 3.76% | |

| Mayotte | iOS | 32.25% |

| Android | 47.45% | |

| Desktop & Web | 20.30% | |

| Namibia | iOS | 22.20% |

| Android | 70.42% | |

| Desktop & Web | 7.38% | |

| New Caledonia | iOS | 53.23% |

| Android | 42.03% | |

| Desktop & Web | 4.73% | |

| Niger (the) | iOS | 17.91% |

| Android | 71.44% | |

| Desktop & Web | 10.65% | |

| Norfolk Island | iOS | 50.78% |

| Android | 39.85% | |

| Desktop & Web | 9.37% | |

| Nigeria | iOS | 8.92% |

| Android | 81.96% | |

| Desktop & Web | 9.12% | |

| Nicaragua | iOS | 2.68% |

| Android | 96.73% | |

| Desktop & Web | 0.59% | |

| Niue | iOS | 23.54% |

| Android | 62.44% | |

| Desktop & Web | 14.02% | |

| Netherlands (the) | iOS | 25.22% |

| Android | 44.26% | |

| Desktop & Web | 30.51% | |

| Norway | iOS | 42.62% |

| Android | 36.89% | |

| Desktop & Web | 20.50% | |

| Nepal | iOS | 35.69% |

| Android | 33.85% | |

| Desktop & Web | 30.46% | |

| Nauru | iOS | 21.50% |

| Android | 67.88% | |

| Desktop & Web | 10.62% | |

| New Zealand | iOS | 26.74% |

| Android | 45.23% | |

| Desktop & Web | 28.02% | |

| Oman | iOS | 36.10% |

| Android | 58.65% | |

| Desktop & Web | 5.24% | |

| Pakistan | iOS | 13.29% |

| Android | 58.09% | |

| Desktop & Web | 28.63% | |

| Panama | iOS | 10.96% |

| Android | 85.21% | |

| Desktop & Web | 3.83% | |

| Pitcairn | iOS | 76.02% |

| Android | 23.32% | |

| Desktop & Web | 0.66% | |

| Peru | iOS | 24.94% |

| Android | 53.49% | |

| Desktop & Web | 21.58% | |

| Philippines (the) | iOS | 23.42% |

| Android | 68.32% | |

| Desktop & Web | 8.26% | |

| Palau | iOS | 45.39% |

| Android | 53.30% | |

| Desktop & Web | 1.31% | |

| Papua New Guinea | iOS | 5.87% |

| Android | 59.92% | |

| Desktop & Web | 34.21% | |

| Poland | iOS | 17.45% |

| Android | 48.75% | |

| Desktop & Web | 33.80% | |

| Puerto Rico | iOS | 38.63% |

| Android | 42.25% | |

| Desktop & Web | 19.12% | |

| Korea (the Democratic People’s Republic of) | iOS | 69.81% |

| Android | 30.19% | |

| Desktop & Web | ||

| Portugal | iOS | 27.08% |

| Android | 45.94% | |

| Desktop & Web | 26.99% | |

| Paraguay | iOS | 22.11% |

| Android | 72.36% | |

| Desktop & Web | 5.53% | |

| Palestine, State of | iOS | 50.39% |

| Android | 41.48% | |

| Desktop & Web | 8.13% | |

| French Polynesia | iOS | 47.71% |

| Android | 40.45% | |

| Desktop & Web | 11.84% | |

| Qatar | iOS | 54.00% |

| Android | 36.62% | |

| Desktop & Web | 9.37% | |

| Réunion | iOS | 38.42% |

| Android | 45.70% | |

| Desktop & Web | 15.87% | |

| Romania | iOS | 25.61% |

| Android | 63.01% | |

| Desktop & Web | 11.38% | |

| Russian Federation (the) | iOS | 20.49% |

| Android | 61.25% | |

| Desktop & Web | 18.26% | |

| Rwanda | iOS | 14.76% |

| Android | 76.98% | |

| Desktop & Web | 8.27% | |

| Saudi Arabia | iOS | 51.90% |

| Android | 35.78% | |

| Desktop & Web | 12.33% | |

| Sudan (the) | iOS | 3.75% |

| Android | 90.55% | |

| Desktop & Web | 5.71% | |

| Senegal | iOS | 58.10% |

| Android | 35.14% | |

| Desktop & Web | 6.76% | |

| Singapore | iOS | 42.12% |

| Android | 44.19% | |

| Desktop & Web | 13.69% | |

| South Georgia and the South Sandwich Islands | iOS | 58.63% |

| Android | 41.37% | |

| Saint Helena, Ascension and Tristan da Cunha | iOS | 33.24% |

| Android | 64.99% | |

| Desktop & Web | 1.77% | |

| Svalbard and Jan Mayen | iOS | 54.12% |

| Android | 40.40% | |

| Desktop & Web | 5.48% | |

| Solomon Islands | iOS | 16.64% |

| Android | 54.04% | |

| Desktop & Web | 29.32% | |

| Sierra Leone | iOS | 39.73% |

| Android | 51.42% | |

| Desktop & Web | 8.85% | |

| El Salvador | iOS | 6.49% |

| Android | 88.63% | |

| Desktop & Web | 4.88% | |

| San Marino | iOS | 45.85% |

| Android | 44.56% | |

| Desktop & Web | 9.59% | |

| Somalia | iOS | 23.34% |

| Android | 64.80% | |

| Desktop & Web | 11.87% | |

| Saint Pierre and Miquelon | iOS | 54.00% |

| Android | 41.91% | |

| Desktop & Web | 4.09% | |

| Serbia | iOS | 24.96% |

| Android | 71.38% | |

| Desktop & Web | 3.66% | |

| South Sudan | iOS | 27.78% |

| Android | 65.87% | |

| Desktop & Web | 6.35% | |

| Sao Tome and Principe | iOS | 19.03% |

| Android | 76.15% | |

| Desktop & Web | 4.82% | |

| Suriname | iOS | 42.24% |

| Android | 52.95% | |

| Desktop & Web | 4.81% | |

| Slovakia | iOS | 21.00% |

| Android | 62.68% | |

| Desktop & Web | 16.32% | |

| Slovenia | iOS | 25.05% |

| Android | 54.32% | |

| Desktop & Web | 20.63% | |

| Sweden | iOS | 42.76% |

| Android | 38.51% | |

| Desktop & Web | 18.73% | |

| Eswatini | iOS | 18.12% |

| Android | 48.72% | |

| Desktop & Web | 33.16% | |

| Sint Maarten (Dutch part) | iOS | 31.94% |

| Android | 65.33% | |

| Desktop & Web | 2.73% | |

| Seychelles | iOS | 41.30% |

| Android | 51.99% | |

| Desktop & Web | 6.71% | |

| Syrian Arab Republic | iOS | 9.12% |

| Android | 90.67% | |

| Desktop & Web | 0.21% | |

| Turks and Caicos Islands (the) | iOS | 44.55% |

| Android | 52.96% | |

| Desktop & Web | 2.49% | |

| Chad | iOS | 20.88% |

| Android | 73.90% | |

| Desktop & Web | 5.22% | |

| Togo | iOS | 22.35% |

| Android | 59.04% | |

| Desktop & Web | 18.60% | |

| Thailand | iOS | 38.67% |

| Android | 49.58% | |

| Desktop & Web | 11.76% | |

| Tajikistan | iOS | 13.68% |

| Android | 84.68% | |

| Desktop & Web | 1.64% | |

| Tokelau | iOS | 36.99% |

| Android | 57.74% | |

| Desktop & Web | 5.27% | |

| Turkmenistan | iOS | 16.73% |

| Android | 79.77% | |

| Desktop & Web | 3.50% | |

| Timor-Leste | iOS | 23.80% |

| Android | 62.73% | |

| Desktop & Web | 13.47% | |

| Tonga | iOS | 43.76% |

| Android | 45.40% | |

| Desktop & Web | 10.83% | |

| Trinidad and Tobago | iOS | 18.37% |

| Android | 80.38% | |

| Desktop & Web | 1.26% | |

| Tunisia | iOS | 27.35% |

| Android | 62.74% | |

| Desktop & Web | 9.91% | |

| Turkey | iOS | 31.00% |

| Android | 63.80% | |

| Desktop & Web | 5.20% | |

| Tuvalu | iOS | 25.76% |

| Android | 51.62% | |

| Desktop & Web | 22.62% | |

| Taiwan (Province of China) | iOS | 46.36% |

| Android | 27.85% | |

| Desktop & Web | 25.79% | |

| Tanzania, United Republic of | iOS | 22.21% |

| Android | 69.37% | |

| Desktop & Web | 8.42% | |

| Uganda | iOS | 10.01% |

| Android | 82.01% | |

| Desktop & Web | 7.97% | |

| Ukraine | iOS | 20.73% |

| Android | 76.47% | |

| Desktop & Web | 2.80% | |

| United States Minor Outlying Islands (the) | iOS | 0.28% |

| Android | 99.72% | |

| Desktop & Web | ||

| Uruguay | iOS | 21.01% |

| Android | 68.82% | |

| Desktop & Web | 10.16% | |

| United States of America (the) | iOS | 44.51% |

| Android | 29.89% | |

| Desktop & Web | 25.60% | |

| Uzbekistan | iOS | 21.42% |

| Android | 75.48% | |

| Desktop & Web | 3.11% | |

| Holy See (the) | iOS | 7.80% |

| Android | 70.63% | |

| Desktop & Web | 21.57% | |

| Saint Vincent and the Grenadines | iOS | 14.30% |

| Android | 84.78% | |

| Desktop & Web | 0.92% | |

| Venezuela (Bolivarian Republic of) | iOS | 8.18% |

| Android | 89.30% | |

| Desktop & Web | 2.52% | |

| Virgin Islands (British) | iOS | 40.13% |

| Android | 56.45% | |

| Desktop & Web | 3.42% | |

| Virgin Islands (U.S.) | iOS | 55.03% |

| Android | 43.38% | |

| Desktop & Web | 1.59% | |

| Viet Nam | iOS | 34.11% |

| Android | 58.18% | |

| Desktop & Web | 7.71% | |

| Vanuatu | iOS | 24.15% |

| Android | 50.32% | |

| Desktop & Web | 25.53% | |

| Wallis and Futuna | iOS | 47.08% |

| Android | 46.97% | |

| Desktop & Web | 5.95% | |

| Samoa | iOS | 41.31% |

| Android | 56.13% | |

| Desktop & Web | 2.56% | |

| Yemen | iOS | 14.22% |

| Android | 82.78% | |

| Desktop & Web | 3.00% | |

| South Africa | iOS | 18.05% |

| Android | 59.71% | |

| Desktop & Web | 22.24% | |

| Zambia | iOS | 21.08% |

| Android | 67.03% | |

| Desktop & Web | 11.89% | |

| Zimbabwe | iOS | 29.01% |

| Android | 57.70% | |

| Desktop & Web | 13.29% |

Paid vs organic installs

All platforms global

Organic continued to surge in Q3, with organic gaining another 1% of installs after growing almost 2% in Q2 2024. Organic hit 53.42%; paid installs were at 46.6%.

Interestingly, the web is increasingly important for organic installs.

(Part of this is likely due to measurement gaps between ads, landing pages, and app stores: more on this in upcoming QTRs.)

Android global

Organic is slightly down on Android, at 57.7% of all installs, while paid is at 42.3%.

iOS global

As per usual, iOS is more heavily oriented to paid marketing thanks to the significantly higher revenue app publishers can generate on the platform.

In Q3, that’s even more so than usual.

This quarter, 60.12% of iOS app installs measured by Singular were paid, up from 56.5% last quarter. 39.88% were organic.

Partner contributions: Digital Turbine, Mobile Growth Association, RevX, yellowHEAD, Shamsco, Marcus Burke

The season for user acquisition

As the holiday season approaches, brands ramp up their spending, making user acquisition (UA) more competitive and, inevitably, more expensive. This time of year, the “gift” of traditional UA becomes a pricier endeavor as brands flood digital channels to capture seasonal demand.

However, while traditional UA remains the main attraction, there are a few valuable “stocking stuffers” you can incorporate into your strategy. These added tactics can help optimize UA efforts, ensuring you make the most out of your budget and stand out in the holiday rush.

The peak season delivers gifts – and UA challenges

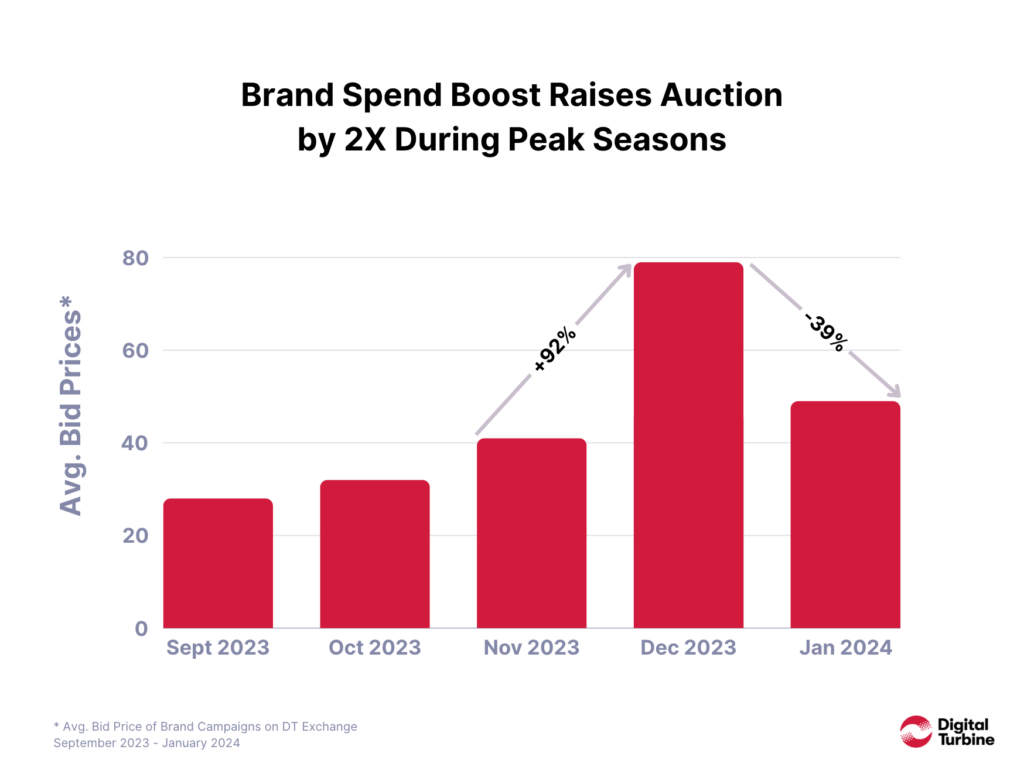

Brand budgets come pouring in as the holiday season warms up, impacting programmatic UA campaigns and the competitiveness of the auction. Winning an auction in November and December will take almost double the spend – making UA campaigns ability to scale challenging.

Direct-to-Device advantage: UA stocking stuffers to turn special days into opportunities

Seasonality plays a crucial role in mobile device sales, with significant peaks during key holiday periods and product launches. Events like Black Friday, Christmas, and New Year drive consumers to purchase new devices, fueled by deals and promotions, while February sees an increase due to major product releases, such as the annual Samsung launch. This cyclical demand presents a valuable opportunity for direct-to-device campaigns.

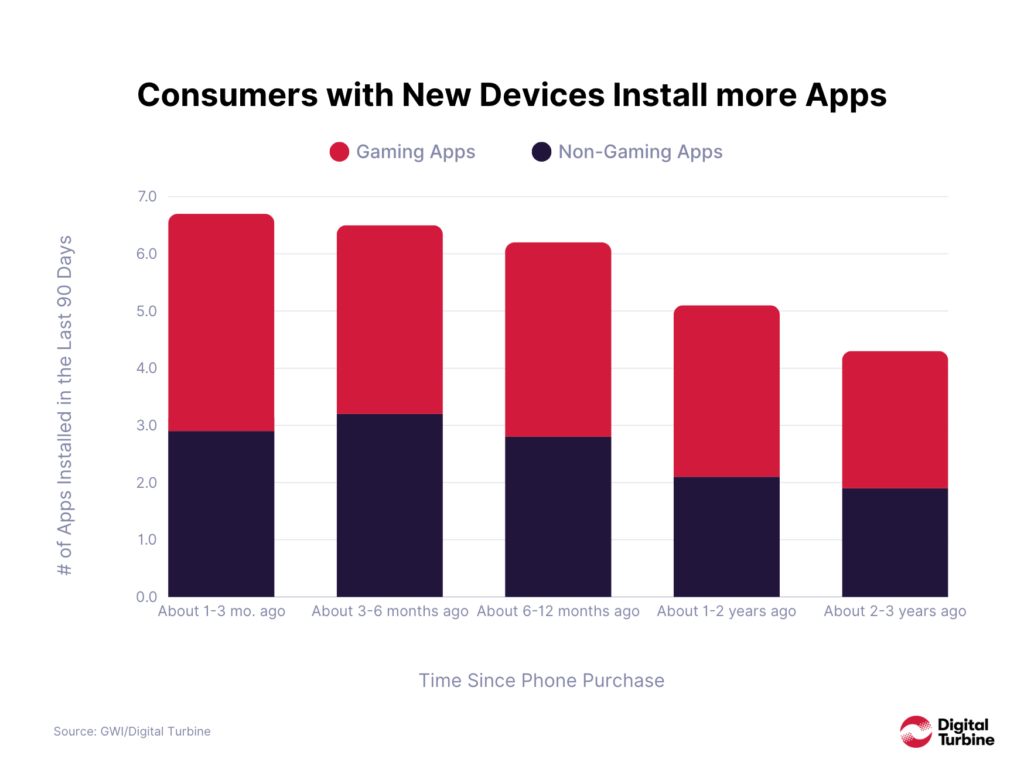

In times where brand programmatic spend peaks, opportunities open up in direct-to-device UA as the influx of these new devices is combined with the tendency of users to be more heavily engaged in app discovery in the first 6-12 months of a new device’s lifespan.

By leveraging on-device user acquisition (UA) strategies during these high-volume times, brands can capitalize on consumer enthusiasm, reaching users who are actively engaged with their new devices immediately after purchase.

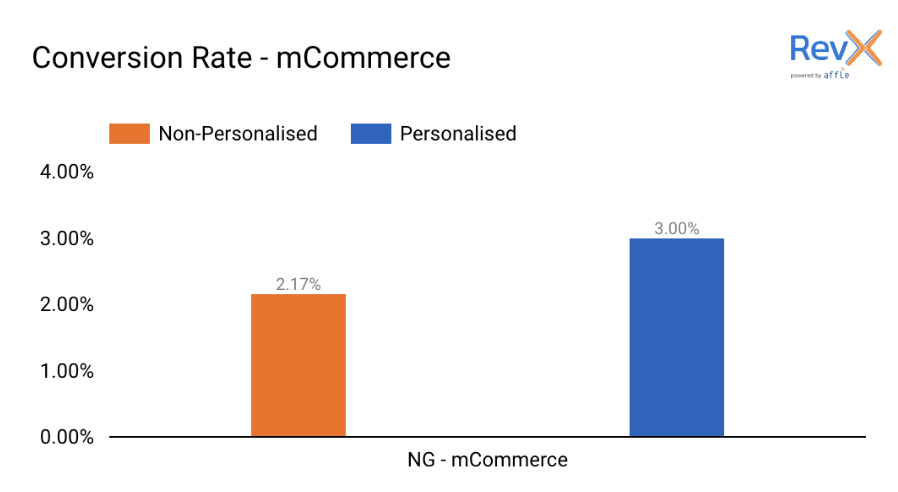

Personalization, AI, and fraud prevention

Research from McKinsey shows that companies proficient in personalization see a 40% boost in revenue compared to those that don’t. This highlights the importance of personalized strategies for businesses looking to enhance both performance and customer satisfaction. As we move into 2025, marketing leaders need to prioritize customer engagement through personalized experiences, while ensuring their tools can support these efforts seamlessly.

A recent report by Talon.One notes that retailers are focusing heavily on personalization across email, mobile apps, and web platforms as their main channels for delivering tailored experiences to consumers. AI is playing an increasingly significant role in providing marketers with deeper insights into customer behaviors and preferences, allowing for more effective targeting and personalization.

In addition to enhancing personalization, businesses must also prioritize fraud prevention to maintain brand integrity and reduce financial risk. Adopting advanced technologies like AI and blockchain can help ensure secure transactions and protect customers from fraud, which builds trust and strengthens customer relationships. Safeguarding against fraud not only preserves the customer experience but also saves businesses from costly disruptions and damage to their reputation.

Mobile apps are at the heart of the digital economy, with users relying on them for a wide range of activities, from communication to shopping. eMarketer projects that by 2025, two-thirds of U.S. smartphone users will regularly use retail apps, highlighting the critical role apps play in reaching and engaging consumers. Retailers have the opportunity to provide an omnichannel shopping experience, connecting with customers across various digital platforms.

For established brands, the challenge of staying relevant in this rapidly evolving landscape is becoming more urgent. AI-powered tools are essential in helping brands reimagine and modernize their app experiences, allowing them to meet rising customer expectations. Those who invest in cutting-edge technologies and embrace innovative solutions will be best positioned to thrive in an increasingly competitive market. Brands that demonstrate agility and leverage advanced tools like AI will be the ones leading the way into the future.

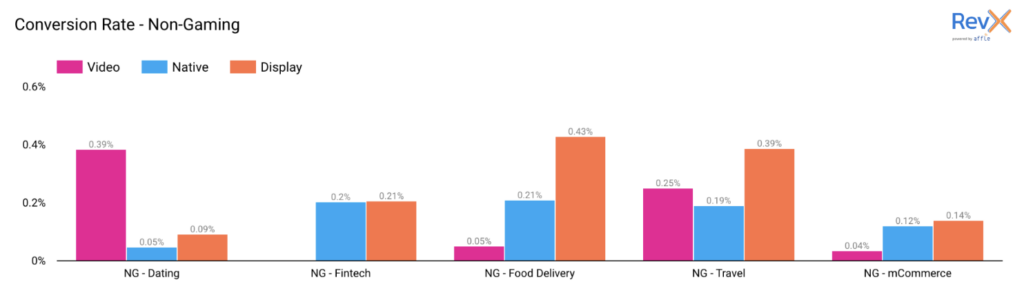

Open and conversion rates by ad format and app category

What ad formats provide better performance by app category for mobile app programmatic campaigns?

High-quality ad creative contributes directly to improved app engagement, lowers cost per (re-) acquisition (CPA), and provides higher post-click performance. We analyzed creative formats by app category across our global retargeting and user acquisition campaigns. We focused on understanding the complete ad journey, from impression to app opens, to in-app purchases (IAPs), ranging from frequent, occasional, or recurring purchases across gaming and non-gaming app categories.

The Q3 2024 data from RevX’s DSP blends iOS and Android campaigns, offering key insights into app engagement by ad format. The goal is to help app marketers maximize creative production from ideation to iteration for mobile programmatic campaigns.

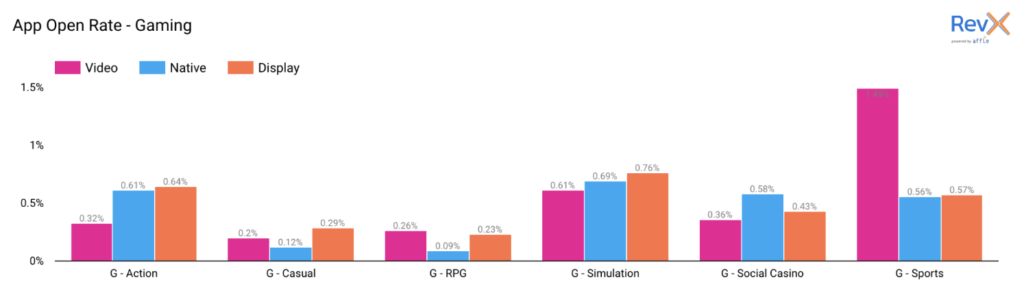

Starting with app open rates for gaming, display (banners and interstitials) had high open rates for action, casual, and simulation, likely due to the cost-effectiveness of acquisition compared to video. For the Sports category, video is in the driving seat to propel open rates.

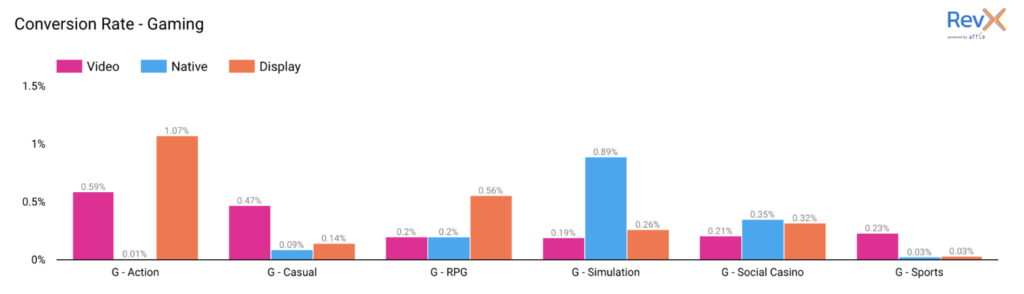

As expected, video ads showed a strong presence across all gaming genres; it was the main conduit for conversions for action and casual. Display ads performed well in action and role-playing games (RPGs), while native ad formats excelled for simulation conversion rates.

For non-gaming app open rates, heightened attention for the dating vertical. There’s still an opportunity for video to improve open rates for fintech, food delivery, and travel but native and display are dominating app engagement for shopping.

For Non-Gaming purchase and subscription behaviors, display ads went the extra mile for food delivery and travel, while video ads continue to capture conversions.

Real-time relevance matters for mCommerce. We found that product feed and dynamic creative optimization (DCO) ads improved user purchase rates by up to 40%.

Recommendations

- Personalization

Incorporate user-level data (products added to cart and/or wishlist, coins, characters, themes or last level played) to deliver more relevant and personalized ads to improve conversion rates. - Dynamic Creative Optimization (DCO)

Use DCO to automatically adapt creatives to different users in real-time based on user-level insights. Maximize personalization to increase conversions. - A/B Testing and Iterattion

Try to keep at least 3-4 localised creative themes live. Once a top performer shows consistent higher metrics, iterate and expand the champion creative while swapping out the weakest creatives. Rinse and repeat to sustain high ad engagement. - Clear Call-to-Action (CTA)

Ensure that your ad has a clear and compelling CTA designed for each ad format and ad size. There are thousands of app ad placements, various ad sizes, and mobile screens. Ideate and improve cut-through on the ad size to stand out with relevant and concise messaging.

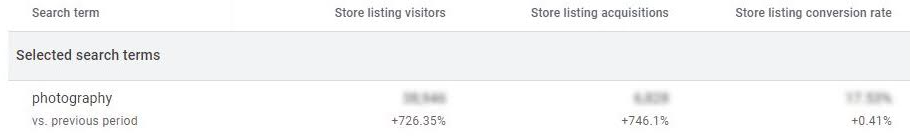

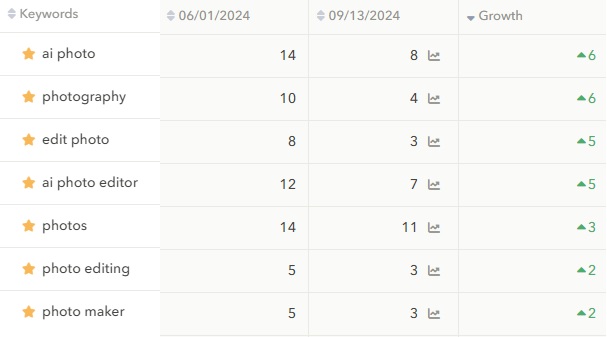

Localizing keyword strategies

We’ve seen massive global traffic and acquisitions surges after Google Play tag changes. Here’s an example:

- +700% global visitors from the term “Photography”

- +700% global acquisitions for the app

After changing the Google Play tag to “Photography” (instead of “social”), a well-known graphic design app experienced a dramatic rise in both traffic and acquisitions.

The impact was most pronounced globally, with a staggering 700% increase in both metrics. This demonstrates the power of optimizing keywords and tags in Google Play, as users searching for photography-related terms were now easily able to discover the app. The traffic and downloads not only surged but were sustained over time, showing how a strategic tag change can drive meaningful growth in app performance.

US-specific growth in keyword rankings and performance

- Photography entered the top 5 non-branded keywords

- +600% in US acquisitions (554 total)

- 2.8K visitors from the term “Photography”

In the US market, the keyword “Photography” entered the top 5 non-branded keywords following the tag change, with a notable 600% increase in acquisitions.

The app gained 2.8K new visitors from users searching for “Photography.” The improvement in keyword rankings demonstrates how optimizing for high-value terms can result in more visibility, which in turn drives higher user engagement and acquisitions. The keyword ranking also became more stable over time, moving from lower positions to solid placements in the top 5 for several photography-related terms.

Growth in key markets – Indonesia and India

- 18K new visitors and 1K acquisitions from “Fotografi” in Indonesia

- +540% in visitors in India from the term “Photography” (18.5K visitors and 3K acquisitions)

The tag change had a particularly strong impact in key markets such as Indonesia and India.

In Indonesia, the app garnered 18K new visitors and over 1K acquisitions from the localized term “Fotografi.” This growth is especially noteworthy because the term previously generated almost no traffic or downloads. In India, the app saw a 540% increase in visitors from the term “Photography,” driving significant new user acquisition.

What this means for your strategy

These results highlight the importance of localizing keyword strategies to capture traffic from specific regions, where the language and search behaviors may differ from global trends.

Testing creatives just for wins isn’t enough

While creatives are one of the most important levers in paid growth, they also pose some of the biggest challenges for app developers and gaming studios. Alongside data usage, privacy changes & working with product teams, creative testing is top of the list of UA teams’ headaches. We address the common key issues for UA teams in detail here.

Interestingly, many user acquisition teams are unaware that their creative processes are not operating at full potential.

What most teams get wrong is the goal of creative testing: They believe that the primary goal of testing is merely to identify winning ads. In reality, your process should also focus on building a robust repository of insights & learnings that will increase your chances of success for future new ads, making your creative testing process more efficient.

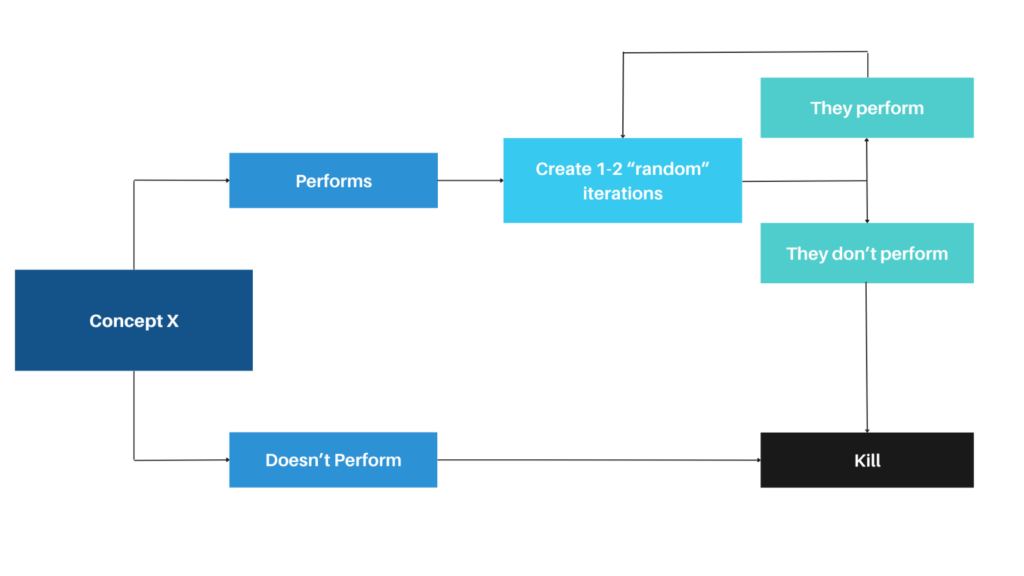

95% of teams we’ve worked with were following the classic Model A:

The classic Model A consists of teams generating numerous creative concepts, believing that the more the better, and then proceed to test them. If a concept doesn’t perform well, they simply pause it; if it succeeds, they create a few random iterations based on various team members’ ideas, and they repeat this process.

The issue with this approach is that it only reveals whether a creative worked or not, without uncovering the underlying reasons for its success. Understanding the “why” is crucial for building valuable insights. While team members may try to speculate on the reasons, guesswork can be avoided by adopting a more structured approach, such as the recommended Model B below, which tests specific hypotheses.

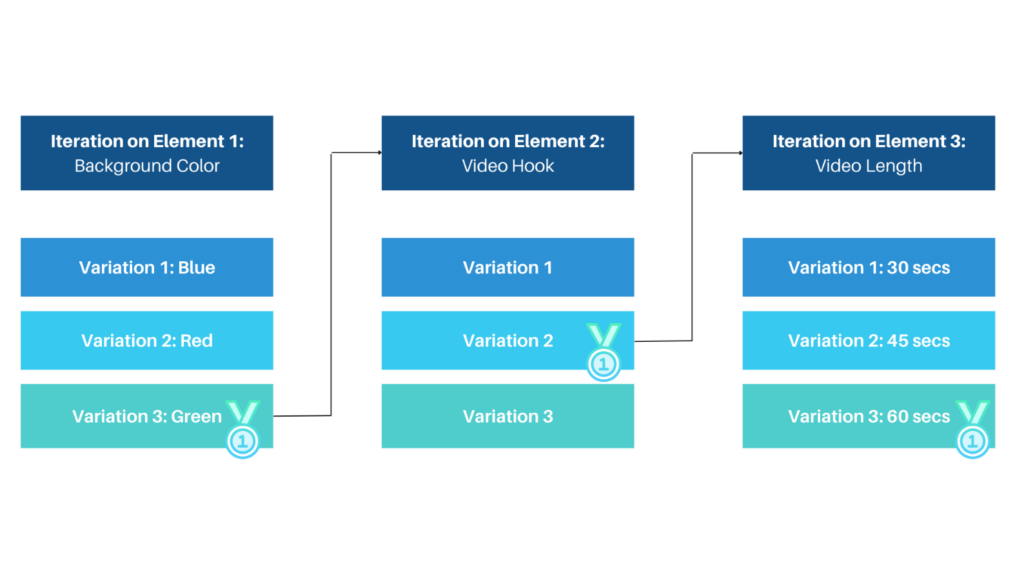

Model B focuses on testing one element at a time within a concept, allowing us to precisely identify why a creative performed well or not, thus eliminating guesswork and relying on data. Through this method, teams aim to build a comprehensive list of winning elements, which can later be mixed and matched to improve creative success rates.

The creative success rate is an important KPI to track, that measures the health but also the performance of your overall creative process. Is you creative success rate improving over time?

Adopting Model B will have a significant impact on the entire creative process—from how the team brainstorms (the most critical stage) to production, testing, and the analysis of creatives. Moreover, it will influence how results are compiled and shared as actionable insights, which then feed back into the process. These learnings are the fuel that keeps the creative engine running smoothly and should improve it’s efficiency.

It’s therefore important to remember that creative testing shouldn’t focus solely on identifying winning ads. The goal is to understand the “why” so that we can gather specific, actionable insights. This is where many developers get it wrong.

We have supported more than 50 developers in refining their creative processes and improving their User Acquisition efforts with the ultimate goal of increasing their bottom line profitability. Our clients include industry leaders such as Rovio, EA, and Netflix Games.

To learn more or get in touch, visit us at Shamsco.

Marcus Burke: Growth of web2app

With the announcement of ATT in 2020, web2app became a topic vividly discussed within the app industry. It appeared to be the easy way out for what Apple had in plan. Yet once people started testing things became relatively quiet.

Apparently moving all your UA efforts to the web wasn’t as easy as expected.

In 2024 web2app is making its comeback.

Martech solutions like Web2wave, Funnelfox, Onboarding.online and Flowriver are popping up left and right. Major players like Headway have shifted meaningful budgets to web-based quizzes and Yeva Koldovska is educating us all about their journey.

As a consultant in the space I feel the industry’s excitement first and foremost in my Linkedin inbox. 20% of my incoming requests are about web2app these days. All my clients are testing web funnels.

What I want to recommend to everyone is using web experiences in a way that allows you to unlock channels and placements by creating a more natural user journey. Yes, quizzes are great but they’re a bit over-hyped right now.

Questions you want to ask yourself:

- How can I have users experience an AHA moment even before the install?

- Where does native content on my main channel or placement redirect and how could my product use similar flows?

- How can I build intent and nurture traffic before I send off to install, registration and other friction points?

For example:

- Blinkist created tons of magazine / article style landing pages to scale on Facebook feed and Twitter where people consume news.

- A financial app could create a portfolio simulator to get users excited before asking for install, KYC and other tough hurdles in the financial space.

- Nutrition apps might bring their AI food or body scanner to the web to create a seamless experience after the ad click and deliver value before ever asking anything back.

That’s the power of the web from my point of view. You get to be creative and innovate flows that don’t lead with a request for install.

All insights are based on anonymized and aggregated data. In addition, each category has been checked for statistical reliability.