Content

Stay up to date on the latest happenings in digital marketing

Web2app spend for mobile user acquisition is growing fast, primarily at the expense of in-app ad spend on iOS.

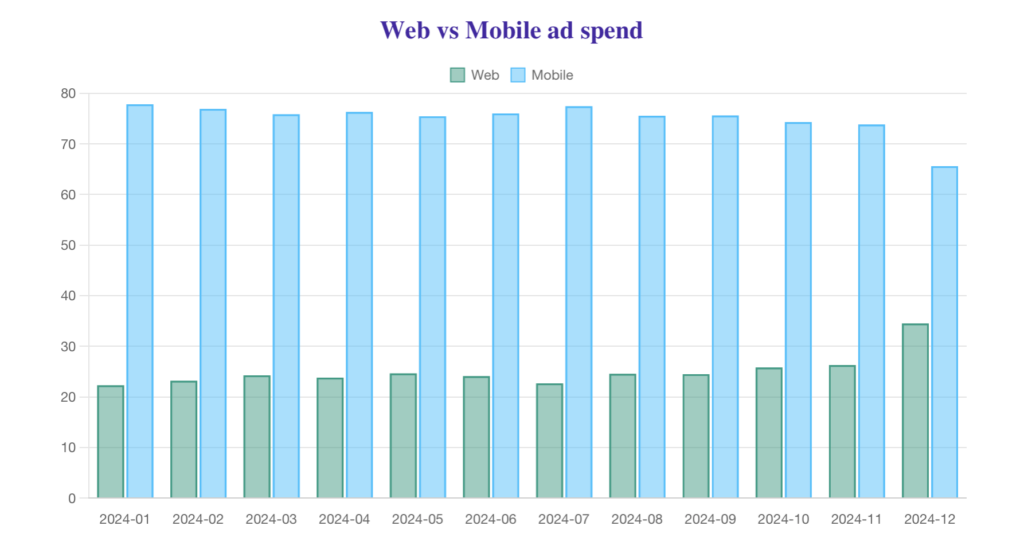

In January 2024, web spend by Singular customers was just 22.23% of overall spend, with in-app ads taking almost 78% of ad spend. By December of 2024, web spend ballooned to 34.45% of overall spend, with in-app down to just over 65%.

That’s a massive 54.39% increase.

But is it sustainable? Or was December’s massive leap a temporary flash in the pan?

(All this data and more is in our latest Quarterly Trends Report for Q1 2025.)

We can’t say definitely right now that web2app spend for UA is going to grow significantly and quickly from December’s numbers, but we can be pretty sure that the overall trend is not a flash in the pan. We saw slow growth throughout most of the year, and the overall difference between Q3 and Q4 is pretty stark:

- Q3: 23.42%

- Q4: 29.51%

What’s going on? Why is this happening?

And what does it mean for UA spend in 2025?

Web2app, UA predictions, and more

We’re going to discuss all of this AND share live UA predictions for 2025 in a special live online event that is open and free for all. It’s called Q1 2025: State of User Acquisition, and you can register here.

Participants will include:

- Jonathan Reich

CEO of Zedge, whose apps have been downloaded about half a billion times - Tomas Yacachury

Strategic partnerships lead at Kayzen and mobile thought leader - Ashwin Shekhar

CRO and co-founder of AVOW - Ben Collins Jones

Solution specialist at SplitMetrics - Stephanie Pilon

CMO at Singular - John Koetsier

VP insights at Singular

Join us simply by clicking here and signing up.

We’ll talk web2 app spend — of course — but we’ll also talk about how AI and LLM-based search engines are impacting mobile user acquisition. And we’ll hit which ad networks are growing fastest, plus UA predictions for 2025.

5 reasons why web2app spend is way up

There are plenty of reasons why web2app spend is up. 1 of them is seasonal, but 4 of them are systemic, deep-rooted, and long-lived.

1. Seasonal ad pricing

CPIs were up in Q4, as you’d expect in a holiday quarter.

User acquisition for games became 15-26% more expensive in Q4 than in Q3, while apps were impacted significantly harder: UA was more than 60% more expensive.

(All data is from our most recent Quarterly Trends Report.)

The result: marketers looked far and wide for alternative supply. That includes smaller and niche mobile ad networks, which were the only networks to grow in Q4, and it includes web. Web ads are not necessarily cheaper than in-app ads, but they can be depending on vertical, timing, and publisher.

And even when the ads themselves are not cheaper, the extra context of a mobile landing page and onboarding flow that you can deliver in a mobile web scenario can result in lower costs for acquiring active, engaged, and paying users.

2. More marketing data

Web2app spend is also up because mobile marketers get more data when doing user acquisition on the web than they do on mobile … at least in iOS since iOS 14.5 and the resulting IDFA scarcity.

Fractional CMO and growth consultant Gessica Bicego recently told me on the Growth Masterminds podcast that web2app can result in about 20% more marketing data: critical data for measuring campaigns, tracking results, and optimizing creative.

3. Different audiences

Web and mobile have slightly different audiences.

Mobile app users skew younger than web users, and while younger people are more likely to want to try new apps and experiences, they’re less likely to be buyers … especially for subscriptions.

Some mobile marketers avoid targeting younger audiences simply because they convert at much lower rates. You can accomplish something similar by prioritizing mobile web.

4. Boosting revenue

If you’re going to try to boost your revenue by paying Apple or Google less in in-app purchase fees, you need a multi-platform business model. Kicking off your client relationships on the web rather than in an app is a great way to start.

Some games have used this kind of web2app strategy to boost revenue by 30%. Others take 80% of their payment off-platform.

Both are reasons to boost web2app spend.

5. Onboarding advantages

Onboarding on the web can be smooth, seamless, and profitable. You have a lot more flexibility to do what you want on a mobile web page than you do in a mobile ad or on your App Store listing.

By the time a new user, player, or customer clicks on a deeplink to actually get your app, you can greet them with a personalized experience on first launch plus also have gathered data that will inform how you treat them in the future.

It’s a strategy that Bicego has used with great success for multiple clients:

“You’re not just asking questions to collect data. You’re creating a journey that makes users feel heard and understood,” she says.

Web2app spend: likely to continue to grow

While January and February are likely to be down from December’s massive jump in web2app spend, the overall trend has legs.

Check back for our next Quarterly Trends Report to see the actual data, but my prediction is that the overall trajectory will continue to grow even if we see a slight temporary dip.

Oh and don’t forget to sign up for our big live event: Q1 2025: State of User Acquisition.