Top 100 fintech apps 2025: who’s winning and who’s growing

Fintech is eating banking. Every traditional bank wants to be a digital bank, and every payments app, wallet app, and other kind of fintech app wants to be a neobank. But who’s winning? And what fintech apps are leading in 2025?

I took a look at the top 100 fintech apps in the world right now by downloads over the past 90 days. Here’s what I’m seeing globally for the top fintech apps across both iOS and Android. Each top fintech app for 2025 is listed with the country of origin and the category that it belongs in, and growth is averaged across both iOS and Android apps:

| Rank | App Name | Country | Category |

|---|---|---|---|

| 1 | PhonePe: Secure Payments App | India | Payments |

| 2 | Airtel Thanks: Recharge & Bank | India | Bank |

| 3 | Pi Network | United States | Cryptocurrency |

| 4 | PayPal – Pay, Send, Save | United States | Payments |

| 5 | Paytm: Secure UPI Payments | India | Payments |

| 6 | DANA Dompet Digital Indonesia | Indonesia | Digital wallet |

| 7 | Binance: Buy Bitcoin & Crypto | Malta | Cryptocurrency |

| 8 | Google Pay: Save, Pay, Manage | United States | Payments |

| 9 | UnionPay APP | China | Payments |

| 10 | Mobile JKN | Indonesia | Billing |

| 11 | Nu | Brazil | Bank |

| 12 | ShopeePay – Gebyar Ramadan | Indonesia | Payments |

| 13 | Mercado Pago: cuenta digital | Argentina | Bank |

| 14 | Electronic Taxation Bureau | China | Taxes |

| 15 | Google Wallet | United States | Digital wallet |

| 16 | Revolut: Send, spend and save | United Kingdom | Bank |

| 17 | Navi: UPI, Investments & Loans | India | Bank |

| 18 | Klarna | Shop now. Pay later. | Sweden | BNPL |

| 19 | Bajaj Finserv Loans, UPI & FD | India | Bank |

| 20 | Banco Itaú: Conta, Cartão e + | Brazil | Bank |

| 21 | Alipay – Simplify Your Life | China | Payments |

| 22 | Personal income tax | China | Taxes |

| 23 | PicPay: Conta, Cartão e Pix | Brazil | Bank |

| 24 | Groww Stocks, Mutual Fund, IPO | India | Investments |

| 25 | Phantom – Crypto Wallet | United States | Cryptocurrency |

| 26 | YONO SBI:Banking and Lifestyle | India | Bank |

| 27 | Cash App: Mobile Banking | United States | Bank |

| 28 | GoPay: Transfer Pulsa Bills | Indonesia | Payments |

| 29 | super.money – UPI by Flipkart. | India | Bank |

| 30 | Coinbase: Buy BTC, ETH, SOL | United States | Cryptocurrency |

| 31 | FGTS | Brazil | Insurance |

| 32 | Agricultural Bank of China | China | Bank |

| 33 | Angel One: Stocks, Mutual Fund | India | Investments |

| 34 | Kotak811 Mobile Banking & UPI | India | Bank |

| 35 | World App – Worldcoin Wallet | United States | Cryptocurrency |

| 36 | IPPB Mobile Banking | India | Bank |

| 37 | Intuit Credit Karma | United States | Bank |

| 38 | Bybit: Buy & Trade Crypto | Singapore | Cryptocurrency |

| 39 | Zapay: pagar IPVA 2025, Detran | United Kingdom | Payments |

| 40 | Trust: Crypto & Bitcoin Wallet | United States | Cryptocurrency |

| 41 | OKX: Buy Bitcoin BTC & Crypto | Seychelles | Cryptocurrency |

| 42 | TradingView: Track All Markets | United States | Investments |

| 43 | MobiKwik: BHIM UPI & Wallet | India | Digital wallet |

| 44 | CAIXA Tem | Brazil | Bank |

| 45 | Industrial and Commercial Bank of China | China | Bank |

| 46 | GCash | Philippines | Payments |

| 47 | TurboTax: File Your Tax Return | United States | Taxes |

| 48 | Easy Personal Loan – KreditBee | India | Loans |

| 49 | BRImo BRI | Indonesia | Bank |

| 50 | Inter&Co: Financial APP | Brazil | Bank |

| 51 | CAIXA | Brazil | Bank |

| 52 | Wise: International Transfers | United Kingdom | Payments |

| 53 | Sweatcoin Walking Step Counter | United Kingdom | Cryptocurrency |

| 54 | Crypto.com – Buy BTC, XRP, ADA | Singapore | Cryptocurrency |

| 55 | Electronic Taxation Bureau | China | Taxes |

| 56 | Serasa: Consulta CPF e Score | Brazil | Loans |

| 57 | MetaTrader 5 | Cyprus | Cryptocurrency |

| 58 | Traffic fines | Russian Federation | Fines |

| 59 | PhonePe Business: Merchant App | India | Bank |

| 60 | bKash | Bangladesh | Digital wallet |

| 61 | Pocket Broker – trading | Costa Rica | Investments |

| 62 | Venmo | United States | Payments |

| 63 | TrueMoney | Thailand | Bank |

| 64 | BYOND by BSI | Indonesia | Bank |

| 65 | testerup – earn money | Germany | Earning |

| 66 | Méliuz: Cashback, Cartão e + | Brazil | Rewards |

| 67 | FamApp by Trio: UPI & Card | India | Payments |

| 68 | InfinitePay Tap, Conta, Cartão | Brazil | Payments |

| 69 | SeaBank | Indonesia | Bank |

| 70 | Chime – Mobile Banking | United States | Bank |

| 71 | POP:UPI, Shopping, Credit Card | India | Payments |

| 72 | Bank of China | China | Bank |

| 73 | Investing.com: Stock Market | Cyprus | Investments |

| 74 | MB Bank | Vietnam | Bank |

| 75 | Capital One Mobile | United States | Bank |

| 76 | Bitget- Trade bitcoin & crypto | United States | Cryptocurrency |

| 77 | MetaMask – Crypto Wallet | United States | Cryptocurrency |

| 78 | Branch – Digital Bank & Loans | United States | Bank |

| 79 | Loterias CAIXA | Brazil | Bank |

| 80 | GoodScore: Credit Score App | India | Loans |

| 81 | Shriram One: FD, UPI, Loans | India | Bank |

| 82 | Government services | Luxembourg | Taxes |

| 83 | Olymptrade – Trading online | Grenada | Investments |

| 84 | mPokket: Instant Loan App | India | Loans |

| 85 | Zelle | United States | Payments |

| 86 | Official Traffic Fines | Russian Federation | Fines |

| 87 | Banco Santander Brasil | Brazil | Bank |

| 88 | Moneyview: Loans, Credit Cards | India | Bank |

| 89 | CoinMarketCap: Crypto Tracker | United States | Cryptocurrency |

| 90 | Remitly: Send Money & Transfer | United States | Payments |

| 91 | Rocket Money – Bills & Budgets | United States | Payments |

| 92 | CoinDCX: Crypto Investment | India | Cryptocurrency |

| 93 | Postal Savings Bank | China | Bank |

| 94 | OPay | Nigeria | Bank |

| 95 | MoneyLion: Banking & Rewards | United States | Bank |

| 96 | Banco will: Cartão de crédito | Brazil | Bank |

| 97 | ATTO | United States | Loans |

| 98 | Banco do Brasil: Conta Digital | Brazil | Bank |

| 99 | Banco Bradesco | Brazil | Bank |

| 100 | easypaisa – Payments Made Easy | Pakistan | Payments |

I’ve translated some of the Chinese and Russian names, but left the Spanish names as it, since they use the same alphabet as English. Note that where the app is based does not govern where it is marketed and used, necessarily. And that categories are an estimate, as this is often challenging to determine.

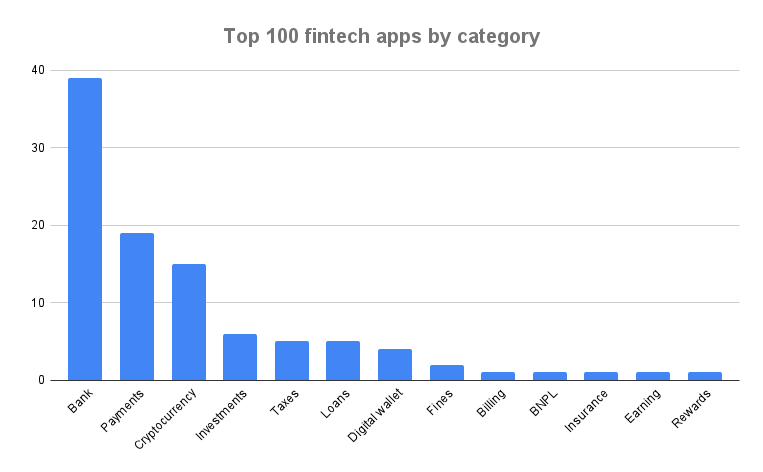

Top fintech apps 2025: top categories

The most immediately obvious insight in this list of top fintech apps is how many of these fintech companies are full-on or near-to banks. What we’ve been seeing over the past few years is that the top fintech apps have been expanding from payments to things like loans, investments, and rewards. Some still focus on 1 or a few main tasks, but many are trying to land and expand: get customers for 1 thing, and then offer multiple investment services.

So what we’re seeing is that 3 categories dominate: banking, payments, and cryptocurrency:

- Bank – 39

- Payments – 19

- Cryptocurrency – 15

- Investments – 6

- Taxes – 5

- Loans – 5

- Digital wallet – 4

- Fines – 2

- Billing – 1

- BNPL – 1

- Insurance – 1

- Earning – 1

- Rewards – 1

Interestingly, BNPL (buy now pay later) is still a hot category, but most of the former players have added other services and so now fit into larger, more inclusive categories. Payments is still super-hot, and it’s a category where you typically see huge usage and engagement, especially in countries like China and India where digital payment is more a way of life than in the U.S., UK, or Germany, for example.

Newer categories I’m see pop up include government apps (and third-party apps) for paying fines, paying taxes, and getting benefits like employment insurance.

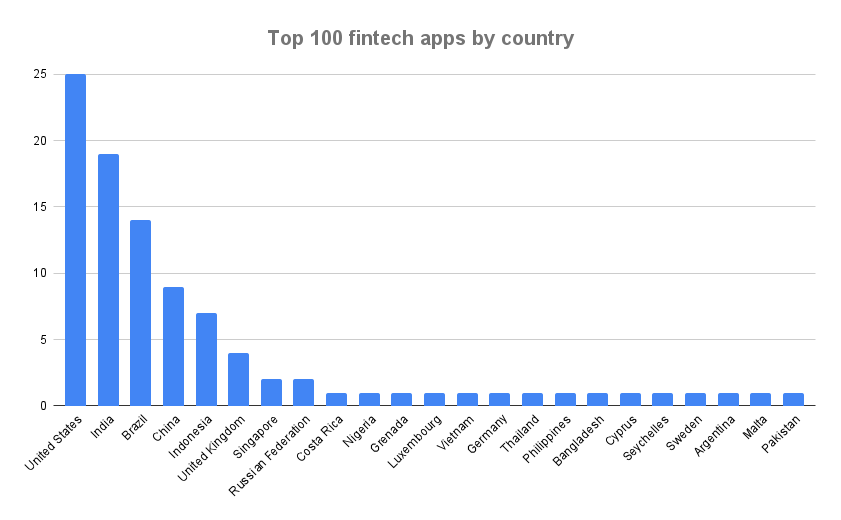

Top fintech apps 2025: top countries

Another insight in the top fintech apps list: many more countries are getting into the fintech space in a big way than we’ve seen in the past. Where before we would have seen China and India and the United States, we now see multiple European and Asian countries as well:

Of course, the United States, India, Brazil, and China dominate, but Indonesia and the UK are fairly prominent as well. And there’s a significantly long long tail for this chart:

- United States – 25

- India – 19

- Brazi -l 14

- China – 9

- Indonesia – 7

- United Kingdom – 4

- Singapore – 2

- Russian Federation – 2

- Costa Rica – 1

- Nigeria – 1

- Grenada – 1

- Luxembourg – 1

- Vietnam – 1

- Germany – 1

- Thailand – 1

- Philippines – 1

- Bangladesh – 1

- Cyprus – 1

- Seychelles – 1

- Sweden – 1

- Argentina – 1

- Malta – 1

- Pakistan – 1

But let’s be honest: there are a ton of fintech startups and apps in the United States because it is wealthy and high-tech. And there are so many fintech startups, payments, and digital banking companies in India and China because those nations are huge and they have adopted mobile-first digital payments and banking technology like almost no other countries.

The future of fintech

Fintech is a super-interesting category right now. There’s still a significant growth trajectory in 2025 and beyond.

On the 1 hand, investment is down, with global startups raising the least since early 2020, but public valuations are up a sign that the massive Covid-era investments are paying off in real business value. And the outlook is positive too: fintech has a projected market size of $1.5 trillion in revenue by 2030.

The good news for fintechs focused on mobile is that mobile is central to the rise of fintech now and increasingly in the future:

- Mobile apps are central to consumer fintech interactions

- Payment apps, digital wallets, and mobile banking are seeing strong adoption rates

- And innovations in connected commerce, in which banks and fintech companies use mobile data to offer personalized financial services, are growing too

This is most true in China. It’s incredibly adopted in India. It’s huge in Asia and parts of Africa. And over time, it’s increasingly becoming the norm in Western Europe and North America as well, despite the adoption challenges among the cash-obsessed older generation.

In other words, this is a category worth paying attention to.

Fintech is older than you think … literally over 100 years old

Fintech didn’t get its start when Apple invented the iPhone. Believe it or not, fintech is actually pretty old. In fact, if we define financial technology as digital or electronic means of dealing with money, fintech has its roots over a hundred years ago. No, there was no internet, but there were digital communications.

In 1918, the U.S. Federal Reserve built the Fedwire Funds Service, which still exists today. Using Morse code on public telegraph circuits, the Fed ensured that the U.S. dollar was worth the same amount in Pittsburgh as in Poughkeepsie, in Seattle as in San Antonio, and that interbank transfers could happen without time-consuming and risky transfers of cash or gold.

Much later in 1995, Wells Fargo — yep, the same company that operated the Pony Express in 1861 — made the first online checking account available.

And on May 22, 2010, a day that will forever be remembered as Bitcoin Pizza Day, Laszlo Hanyecz became the first person to spend cryptocurrency to purchase a physical item: a Papa John’s pizza. Hanyecz spent 10,000 bitcoin for the pizza, which would be worth approximately $650 million USD today. That is probably the most expensive pizza in history. I hope Hanyecz saved some other cryptocurrency for selling later when Bitcoin was actually worth real money.

When we think of fintech today, however, we think of new tech that manages, sends, invests, stores, and maximizes our money. And largely, we think of mobile apps as well as companion websites.

Categories and sub-verticals within fintech

There are likely as many different categorizations of fintech as people thinking about the category, but here’s an overview that simplifies the diversity in fintech as much as possible.

| Fintech categories | Examples & top players |

| Banking | Branch, Airtel, Nu, Mercado Pago, Bank of America, Chase, Wells Fargo, Credit One, Navy Federal, US Bancorp, Citigroup |

| Budgeting | Mint, PocketGuard, Goodbudget, Honeydue, Personal Capital, YNAB, Everydollar, Intuit, Apple Pay |

| Buy now, pay later (BNPL) | Afterpay, Perpay, PayPal Pay in 4, Klarna, Affirm, Sezzle |

| Credit history & monitoring | Credit Karma, Experian, Credit Sesame, MyFICO |

| Cryptocurrency, decentralized finance (DeFi) | CoinDCX, CoinMarketCap, MetaMask, Coinbase, Binance, Crypto.com, Trust, Voyager, River, eToro, Webull, Gemini, BlockFi |

| Education | World of Money, Zogo, Investmate, Penny, Bankaroo, FamZoo, iAllowance, NerdWallet |

| Insurance | FGTS (Brazil), Geico, Progressive, Lemonade, Allstate, State Farm, Jerry.ai, Esurance, Metromile |

| Investment | Pocket Broker, TradingView, Robinhood, Stash, Webull, Acorns, Public, SoFi, eTrade, Ameritrade, JP Morgan |

| Loans | ATTO, mPokket, Serasa, Brigit, MoneyLion, Dave, Earnin, Albert, NIRA, MoneyTap, EarlySalary, Buddy, Cleo, Varo |

| Neobanks | N26, Chime, SoFi, Monso, Dave, Current, Tinkoff, MoneyLion, Starling Bank |

| Payments | PhonePe, Apple Pay, Google Pay, PayPal, Venmo |

| Tax | TurboTax, TaxAct, H&R Block, Electronic Taxation Bureau (China), Personal income tax (China) |

| Transfers/sending money | Remitly, Western Union, TransferWise, MoneyGram, Cash App, Apple Pay, Google Pay, Xoom, Facebook Messenger |

As mentioned above, however, we’re seeing more and more consolidation in fintech. the top 100 fintech apps are all growing.

Payments apps want to be digital wallets. Digital wallets want to be banks. Banks want to offer insurance and investments. Essentially, once you have customers on your platform, it’s much easier to expand the services that they use. The more services they use, the more lucrative it is for the fintech providers, which is why the top 100 fintech apps have so many apps that offer multiple services for their users.

And it just makes sense for people too.

Wouldn’t you rather deal with 1 or 2 fintech companies than 5 or 6 … all of which need to have your financial details, your banking details, your payment information, and more? I know I would.

Big Tech and fintech: Apple, Google, Amazon

I mentioned earlier that Apple Pay didn’t even show up on the list of the top 50 payment apps on either platform because it’s a default in iOS. In fact, my new iPhone 16 Pro Max told me almost every day that my device set-up was incomplete until I finally gave up and set up Apple Pay by loading in my credit cards.

What’s interesting about Apple Pay is that it is deep integrated into both Apple’s mobile operating system and desktop. Plus, Apple has the innovative Apple Card — which is still U.S.-only — but offers no fees, ground-breaking family budgeting features, cash back, and useful data on spending patterns.

In addition, Apple Pay has simply huge existing reach and even more massive growth potential:

- Apple Pay has 744 million users globally as of 2024

- Apple Pay handled 1.8 billion transactions last year: up 40%

- Over 90% of U.S. retailers accept Apple Pay

But there are still challenges. More than 90% of iPhone users who could use Apple Pay for in-store purchases still opt for traditional payment methods. (Yeah, I’m 1 of those. I sometimes use my phone for purchases, but not frequently.)

Plus the other big tech companies aren’t laying down and conceding the market.

- Google has a much larger global userbase to convert to its financial apps

- Google had over 150 million active users in 2022, which has certainly grown in the last 3 years

Google is also working with retail partners like Albertsons to integrate their operations with Google Pay. And there are enough Google fans on iOS who choose Google’s payment service over Apple’s that Google Pay is a top-25 app in the fintech category of the App Store.

In addition, Google has significant capabilities, installed base, and advantages in voice-based commerce on Google Home and in the Google app on both Android and iOS, suggesting that as customers get more and more used to asking Alexa, Siri, or Google to order more toilet paper or rent a movie, Google will do well here.

The rest of big tech is busy in fintech as well.

As you’d expect, Microsoft is working more on the business side of fintech, while Amazon has offered Amazon Pay since 2007 and has acquired fintech companies enabling both online and offline purchases. And, of course, Amazon is one of the biggest e-commerce companies outside of China. Facebook (or Meta) also offers some payment technologies, and as Facebook Marketplace gets bigger and more important, we might see some integrations there.

Top 100 fintech apps 2025: the challenge

COVID normalized digital banking, and the result was massive growth in fintech app usage, especially in the payments and banking categories. That’s only grown since.

The challenge for 2025 is to keep new users while continuing to expand both customer base and solution set. In some sense there’s a race to the middle between banks and neobanks. Traditional banks need to continue to get more digital and mobile. Neobanks in many cases need to offer more services and capabilities to amortize the cost of customer acquisition over more revenue-generating events … and to avoid losing customers to one-stop-and-you’re-done fintech competitors.

The challenge for fintechs today is to continue to grow in this hyper-competitive market that has been flooded with new cash. Finding the most optimal means of customer acquisition will be a huge competitive advantage, as well-funded rivals are almost guaranteed to be spraying money around like it’s the dot-com boom all over again. And with 26,000 fintech startups globally, this is not going to be an easy sector to win in.

Growth marketers and fintech

Growth marketers have a significant challenge in fintech. Your rivals literally have billions of dollars in new investment. Most of your top competitors have grown significantly through lockdown and quarantine periods.

What’s the best path forward?

Making sure every dollar of spend provides ROI. Optimizing ROAS across new, innovative channels and platforms. Killing poorly-performing partners quickly. Getting the best and the quickest insight into growth opportunities.

It won’t be easy.

Singular can help you grow

If you’re a fintech startup and are looking for marketing intelligence that can drive growth, and marketing measurement that provides the best insights for ROI optimization, book some time with Singular.

Grab a slot here, and let’s chat. We’ll listen more than we talk, understand your business and your needs, and share what we can do to help.

Stay up to date on the latest happenings in digital marketing