CTV milestone: streaming zooms to a record high, while old-fashioned broadcast & cable falls below 50%

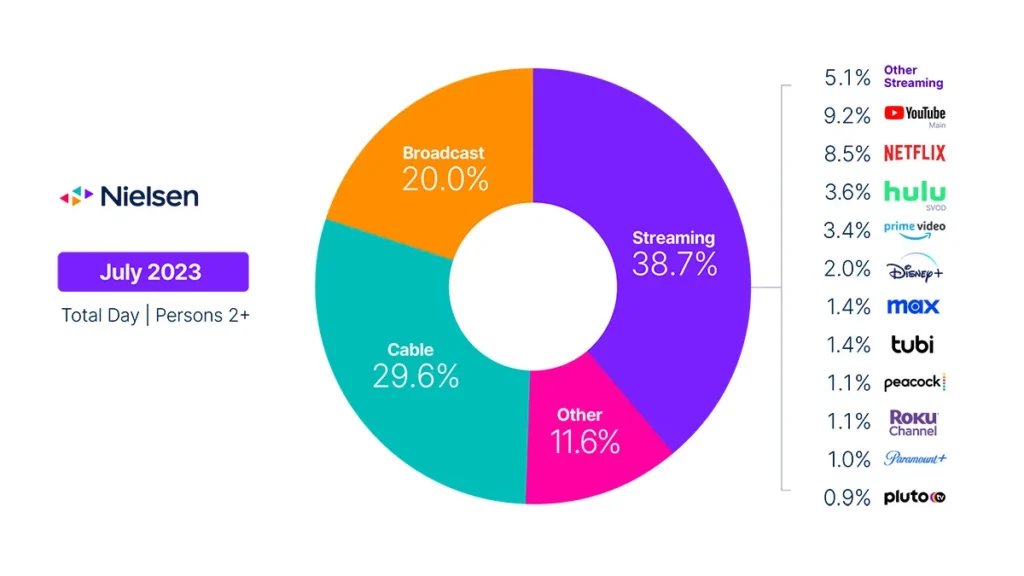

Earlier this year an M&C Saatchi executive told me that ad-supported CTV represented just 18% of TVish video ad spend, while good old-fashioned linear TV was 57%. That probably hasn’t had much time to change yet, but one massive part of the whole streaming TV, connected TV, and OTT world just did. Yesterday Nielsen reported that streaming TV captured a record 38.7% of all TV viewing in July while broadcast and cable TV dropped below 50% for the very first time.

Included in that streaming TV record: sources such as …

- YouTube

- Netflix

- Hulu

- Prime

- Disney+

- Max (formerly HBO Max)

- Tubi

- Peacock

- Roku

- Paramount+

- Pluto

In fact, the story is stronger than 38.7% for streaming TV.

In an abundance of caution, Nielsen offers a big 11.6% slice of TV labeled “Other.” Look a little deeper, and you find that “Other” includes:

- Unmeasured video on demand (VOD)

- Streaming through a cable set top box

- Audio streaming

- Gaming

- Other device use (DVD, Blu-Ray)

- All other tuning from unmeasured sources

It doesn’t take a massive leap of logic to think that if you add up that VOD and set top box streaming, you’re likely significantly north of 40%.

A caveat on streaming’s big win

There is a caveat on streaming TV’s big win, however. While it is true that linear TV fell below 50% of TVish viewing for the very first time — and it’s true that the trend will continue — linear TV could very well take a temporary U-turn and pop back below that 50% mark over the next few months.

Nielsen explains:

“With kids settled into their summer breaks in July, they continued to have an outsized effect on TV usage. While overall TV usage was up just slightly from June (0.2%), viewing among people under the age of 18 increased 4%, and viewing among adults 18 and older fell 0.3%. These trends resulted in increased streaming and “other” usage, which is primarily attributed to video game consoles.”

In other words, with kids going back to school in August across much of the United States and in September in Canada, some of that streaming will drop. Plus, July was a slow month for sports: football is not yet on, ice hockey and basketball are off as well, and only soccer is in season.

Still, July 2022 to July 2023 still showed a drop-off.

In July 2022, broadcast TV captured a 21.6% share of TV watching, while cable captured 34.4%. In July 2023, broadcast slumped to 20% and cable dropped to 29.6%. Streaming TV, on the other hand, grew from 31.4% to its highest level yet, 38.7%.

More room for ad campaigns on streaming TV

In April when we asked hundreds of marketers in our CTV-focused webinar about user acquisition on streaming TV and other forms of CTV, 45% said they were already running user acquisition campaigns on CTV platforms. (Note: yes, that’s a biased audience.)

Now that old-school TV is less than half the full TV-viewing picture, streaming and CTV and OTT advertising is likely to keep growing. Connected TV ad spend is forecast to be around $39 billion in 2026, but with news like this — and continued focused by streaming platforms on ad-supported tiers of service — that could be an underestimate.

To help you crack the code on maximizing marketing value on CTV, check out this webinar. Or, give us a shout and we’d be happy to chat.

Stay up to date on the latest happenings in digital marketing