PayPal wants to fix retail media by aggregating millions of retail media ad networks

This week, PayPal launched PayPal Ads. The goal: to fix retail media by aggregating 30 million merchants into a single ad network, sort of a demand-side platform for a huge number and wide variety of retail media outlets. And, of course, to monetize the purchasing data of 429 million active PayPal users.

Retail media is exploding, of course.

Ride-sharing giants Uber and Lyft do it — Uber Ads is reportedly a $1 billion business — Amazon has basically perfected it into a massive $42 billion profit-making machine, Walmart is doing retail media, and so are Instacart, eBay, Shopify plus hundreds if not thousands of other apps, retailers, and brands.

And why not?

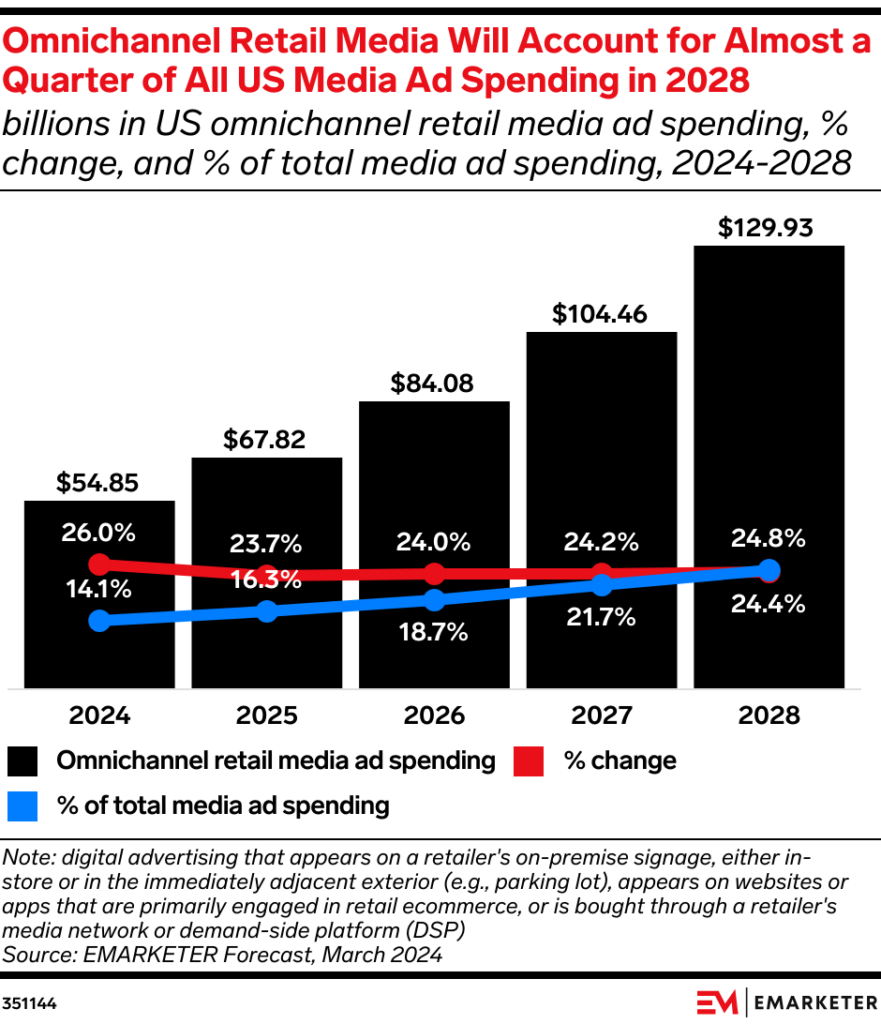

According to WARC, retail media will hit $142 billion this year, a massive number for a category that only started getting attention in the past few years. It’s growing at over 20% for the next 4 years, says eMarketer, and is set to become literally a quarter of all US ad spend in 2028.

That’s shocking, literally shocking growth.

But — of course — there’s a problem.

Retail media has a big problem: no “Google AdSense”

If an advertiser wants to buy ads in retail media networks, they’re largely stuck in the dark ages of digital advertising: doing deals with individual retail media outlets 1 by 1.

That’s fine, to a degree, if you only want to access inventory from a few large retailers or brands, but it gets tedious and tiresome if you want to aggregate bigger audiences. And it also renders the long tail of retail media basically inaccessible and therefore underutilized, undervalued, and under monetized.

For advertisers on Amazon this may not be a huge issue.

But for advertisers who might want to target 4.6 million Shopify stores across 170 countries, it certainly is.

This is no huge secret and there have been a few different attempts to solve this, of course. UNFI is one for small independent retailers; Axonet is another, Rokt is yet another.

But we have yet to see the Google AdSense of retail media: a truly large aggregator with huge scale. AdSense, of course, allowed millions of websites to monetize at the same time as it allowed advertisers to access potential customers across those very same millions of websites.

No such platform exists yet for retail media, although Rokt might be coming close (more on that later).

PayPal to the rescue

PayPal thinks it has the solution to this emerging problem.

It already has scale at over 429 million active users: much more in the Western world than any individual retailer not named Amazon or Walmart or Apple (yeah, Apple is a top retailer). And with 30 million merchants, PayPal has size on both sides of the market: buyers and sellers. Which means that potentially, advertisers have a lot of opportunity.

Admittedly, many of PayPal’s 30 million vendors are tiny, but not all: Walmart accepts PayPal for online orders. So does Best Buy. I’ve used PayPal at TicketMaster, Apple accepts it, as do Burger King, Adidas, eBay, Etsy, Bose, and American Airlines.

So there’s definite scale on the retail side as well.

There’s also a ton of data to feed ad targeting and audience assembly: transaction data from those hundreds of millions of users. This is not just high-intent search data or top of funnel signal: it’s actual hard purchases. And since the best predictor of the future is the past — note, I didn’t say perfect, just best — purchase data is kind of the ultimate signal for what people will buy in the future.

“The sheer amount of transaction data that we have at our fingertips is just incredible — it’s much more than any single retailer would ever have,” Mark Grether, a PayPal exec who worked in Amazon’s and Uber’s ad businesses, told AdWeek.

I buy that, with the likely exceptions of the Amazons or Alibabas of the world, or other similar massive retail platforms.

So, PayPal has all the requirements, seemingly:

- A huge number of purchases

- A huge number of vendors

- A huge amount of transaction data

What could go wrong?

Becoming the retail media king won’t be easy

As young as the industry is, there are already heavyweights who loom large in retail media and likely won’t benefit from sharing their customer reach with PayPal. And PayPal’s hope-for ad empire will be limited, for at least some time, to PayPal’s own properties.

Those include:

- PayPal (its own app)

- Venmo, the payment-sharing app Venmo

- Honey, the coupon and cash-back shopping tool

Let’s be clear: that is a huge business driver for PayPal Ads. Each of those apps is significant in its own way. Since PayPal has 429 million users, Venmo has around 90 million users, and Honey has about 20 million users, PayPal as a company has a large user base to begin with, even if those individual user bases largely overlap.

But expansion to retailers’ own sites will start next year, in 2025.

Meanwhile, competitors are already in place aggregating retailers right now, and 1 of them, Rokt, might have a leg up on the others. Rokt Ads “access an exclusive closed marketplace across 4.6B+ transactions on premium eCommerce sites,” the company says. The company boasts clients like Macy’s, Kohl’s Office Depot, HP, Domino’s, AMC Theaters, and TicketMaster, though it’s unclear if all of them use the ad product specifically.

The good news for PayPal is that Rokt says its ads get 3.6% engagement on average, and are 95% viewable. This makes sense, given that with retail media, the publisher has a higher incentive to ensure that not only do visitors/customers see the ads, they also are easy and inviting to engage with.

PayPal can look forward to similar benefits when it gets going both internally and externally.

All in, retail media is going to get more interesting

PayPal Ads is almost guaranteed to achieve success even if it never progresses beyond the company’s owned (and very large and successful) apps. But the true potential lies in aggregating a retail media empire across thousands of significant retailers and millions of long tail retailers.

Whether PayPal can achieve that, time will tell. But if not PayPal, someone else certainly will.

Because 1 thing we’ve learned from adtech in the past 2 decades of massive expansion is that just like nature, advertising abhors a vacuum.

Stay up to date on the latest happenings in digital marketing