IDFA opt-in and iOS 14.5 adoption across 10 major countries: fresh data

Fewer than 20% of iPhone users have updated to iOS 14.5. And fewer than 20% of those agree to allow apps to track their activity to personalize advertising or measure marketing effectiveness.

Singular just pulled a subset of our data to answer key questions that are on mobile marketers’ minds in the aftermath of Apple releasing iOS 14.5:

- How many people are adopting iOS 14.5?

- How many people are accepting tracking when apps ask?

- How is this impacting the mobile advertising ecosystem?

The data sample size here is a representative slice of Singular’s iOS traffic: just under 12 million app installs on iPhones and iPads, all measured and attributed from May 17 to 20.

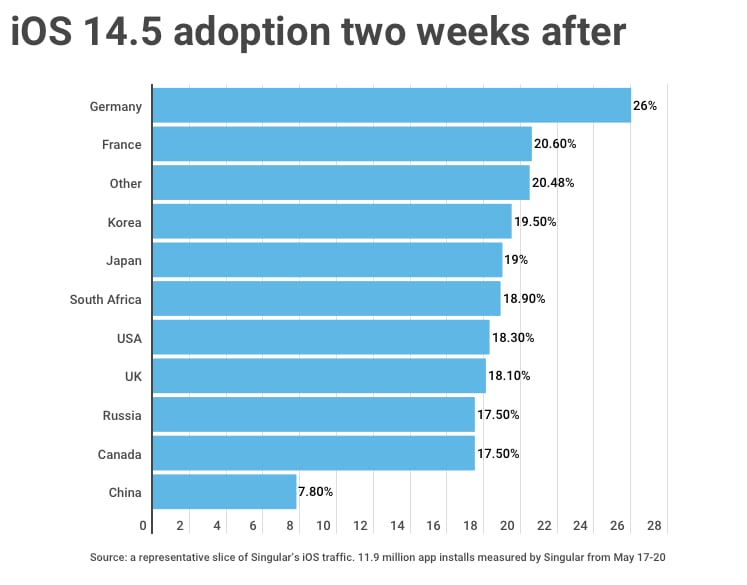

iOS 14.5 adoption rates so far

New versions of iOS are typically adopted quite quickly. For example, iOS 14 reached about 50% adoption within about six weeks of release, and within seven months, was at 90% penetration. Interestingly, you often see significant (10% or more) adoption before an iOS update is even released since so many iPhone owners participate in Apple’s public beta programs.

Point releases generally come with much less fanfare than major new editions and therefore slower adoption. But we’re already seeing fairly quick adoption of iOS 14.5, which finally introduces Apple’s major new mobile privacy features, announced almost 10 months ago at WWDC.

Germany is the quickest to adopt, with a quarter of all German iPhone and iPad owners updating within just a couple of weeks, and China is the slowest, with few than one in ten updating their devices.

The global average is just under 20%.

What that means, of course, is that 80% of global iOS traffic is still using earlier mobile operating systems — mostly iOS 14 or subsequent updates — and is therefore not required to even see the App Tracking Transparency prompt. Marketers can still target these users and will be able to for many months to come if historical patterns hold.

And that’s critically important to note, especially when we start drawing inferences about App Tracking Transparency opt-in rates.

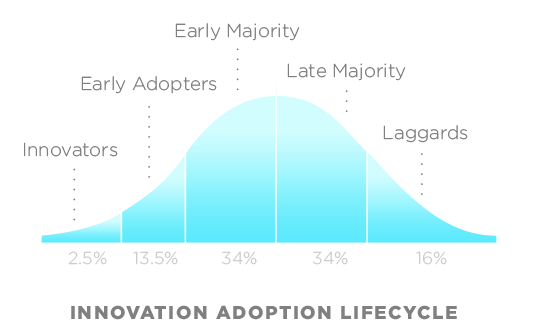

Essentially, we’re barely past the Early Adopter phase. The Early Majority has barely started to register that hey … there’s a new version of the operating system for my phone. And it hasn’t even penetrated the consciousness of the Laggards yet.

Two conclusions are obvious:

- We’re in very early innings of the “IDFA apocalypse”

- What we see happening among early adopters may not bear a resemblance to what happens in the early and late majority of users

That second point is particularly important as we look at the next few data points: ATT visibility rates and ATT acceptance rates.

One caveat on the data sample we’re using: it’s based on new app installs. So people who are not actively installing apps could be under-represented in this data. Those might be people who app developers are less interested in anyways — game developers and growth marketers probably want to target people who download and install new apps at least semi-regularly — but in verticals like banking and retail, marketers want to target broader slices of the market.

App Tracking Transparency visibility rates

Much of the data that we’re seeing in the wild right now focuses on ATT opt-in versus opt-out rates. That’s important information for mobile marketers, but it’s not the first data point to care about. The first data point that matters is how many people will even see the App Tracking Transparency prompt if I choose to show it?

Because the reality is that if someone has turned the Allow Apps to Request to Track setting off in their phone’s or tablet’s settings … they will never even see ATT. Your app will request it, and iOS will deny the request. This is essentially the iOS 14.5 equivalent of limit ad tracking in previous versions of Apple’s mobile operating system. And, in fact, if people have Limit Ad Tracking on, by default iOS 14.5 sets All Apps to Request to Track off. (In addition: this could also be the case for child accounts and managed corporate accounts.)

As it turns out, almost 19% of devices globally are ATT restricted: users will never see your request to allow tracking.

A clear and massive outlier: China, with almost half of iOS 14.5 users opting out of even getting ATT prompts from apps. Most other countries are in the 15-20% range, with the U.S. being a slight outlier on the permissive side. But remember: while China stands out here, fewer than 8% of the iOS devices in China have upgraded to iOS 14.5 so far.

So we could be seeing a statistical anomaly based on what very technical early adopters tend to do.

It’s tempting to think that early adopters are more tech savvy than your average smartphone owner, and more tech savvy people are more likely to make restrictive choices about their digital privacy. That’s entirely possible, but we also see that the older people are, the more privacy-sensitive they are … and younger people are typically digital natives. And we also know that some of the most knowledgeable people, including developers, never upgrade immediately but wait for the almost-inevitable major bugs to be fixed first, upgrading only when iOS 14.5 becomes iOS 14.5.1 or 14.5.2.

So: time will tell if this percentage holds through the early and late majorities. (And we’ll be sharing data on this over the next weeks and months.)

The obvious point, however, is that even in this group of early adopters, most marketers in most countries have the ability to ask more than 80% of their app users and customers for tracking permission. That’s a significant majority.

And in the U.S., that bumps up to 85% (for now).

App Tracking Transparency acceptance rates

If you’ve skimmed to this section because you’re a dessert-first type of person, you’re probably not alone. (But I’m still silently judging you.) This is the most interesting part for many, and it’s what ultimately determines which methods advertisers will be able to use to measure, attribute, and target their users.

The most trusting and giving country so far?

France, and not by a little.

(And remember: more than 20% of French iOS devices that we’ve seen in the past four days have already updated to iOS 14.5.)

Average it all out, and 19.4% of all iOS users both see and allow tracking permission. Interestingly, there seems to be a very consistent grouping of countries at the 23% level, while the rest are mostly in the 15-18% range. China is the lowest at under 14%.

I would suggest caution in reading too much into these numbers right now. As we get more data it would not be shocking to see France revert to the mean a little, and China to increase somewhat as well. There very likely will be national and regional trends, but I would like to see more data over more time from a larger percentage of people in each region before asserting with confidence that the French people love tracking and Chinese people are privacy fanatics.

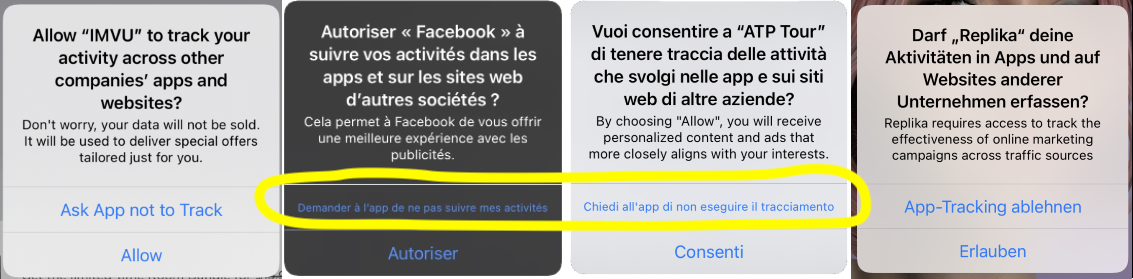

Another potentially important factor, believe it or not: font size.

Thomas Petit, who writes the Mobile Adventures newsletter, shared this image:

Some languages just use more words to say similar things. And so the do-not-allow option in the ATT prompt in French and Italian is almost unreadable, and the allow becomes essentially ALLOW in caps and boldface. This is likely also having an impact, Petit suggests.

Finally, while there’s ultimately only one set of numbers that matter here: how many iOS users give apps tracking permission via ATT … there’s another slice of the data that is worth sharing.

And that’s the number of people who allow tracking as a percentage of those who even get the option in the first place. In other words: if you’ve deselected the Allow Apps to Request to Track setting, you’re excluded from the universe of people who will see the App Tracking Transparency prompt.

Unsurprisingly, these numbers are a little higher. And they also provide more insight into how different regions respond to requests for tracking permission.

France again leads, but Japan, Korea, and South Africa grow significantly. Interestingly, in spite of the huge number of Chinese people who will never see the ATT prompt thanks to their phones’ settings, those who allow apps to request to track and see the App Tracking Transparency prompt respond positively at a high rate: almost 25%.

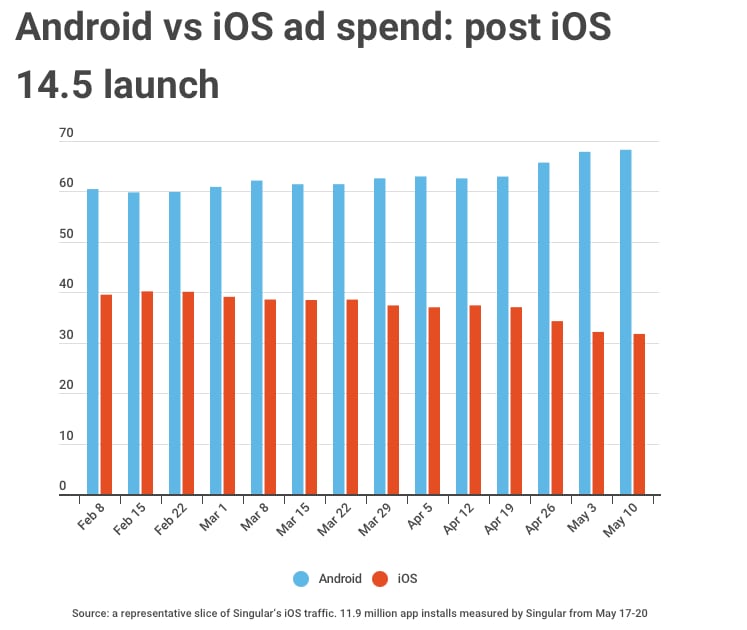

Ad ecosystem impacts: iOS vs Android ad spend

The third major focus for most mobile ecosystem players is: what is iOS 14.5 and its new brand of mobile advertising privacy doing to mobile app install ad spend?

The short answer is: Android’s up and iOS is down.

But, as usual, reality is more complex than that.

There’s a clear downward trend in global ad spend starting in early March, but accelerating around the week of April 26, which coincides precisely with the release of iOS 14.5. Where iOS was 40% of ad spend to Android’s 60%, it’s now just under 32% to Android’s 68.3%.

What that trend means is, of course, the million-dollar question.

There are a number of possibilities here:

- Ad dollars are fleeing an unfavorable iOS measurement environment to Android where targeting and tracking are business-as-usual.

- Ad dollars are still pouring into iOS, but advertisers are not finding as much addressable inventory as they want, so budgets are going unspent.

- Advertisers are pulling back on iOS ad spend until they fully acquaint themselves with the new realities of measurement and optimization.

- It’s some seasonal change that we just haven’t noticed before.

It’s entirely possible that #1 is right and that ad spend is fleeing iOS. And that wouldn’t be a good look for the iOS ecosystem, potentially, if ad dollars — and therefore app monetization — tilt toward Android. That would drive innovation towards Android, which would be challenging for the health of the iOS ecosystem over time.

It’s not the most likely scenario, however.

We certainly did see app install ad prices jump on iOS over the past few months as brands accelerated iOS spend in the early part of 2021. Another strong possibility, however: advertisers are now relaxing to spend as they accommodate to new realities, finalize new piping and plumbing in their tech growth stacks, and have already spent much of their Q2 ad budgets.

It’s also not inconceivable that there’s insufficient inventory available. The No IDFA No Problem alliance, which Singular is a part of, shows SKAdNetwork-compatible inventory at a still-low 59.5%.

And, I haven’t pulled enough data at this point to rule out seasonal variation.

So again: it’s too early to say definitively what is happening and why. We’ll be pulling and sharing more data over the next few weeks and months which should illuminate the situation more.

Stay tuned for more data

Stay tuned to the Singular blog for more data.

Also, we’ll be running an iOS 14.5 Aftermath webinar on May 26 with EA, Gameloft, and Liftoff. Suggestion: register for that, where we’ll share more data and also ask the top mobile marketers at those companies what they’re seeing and how they are reacting.

Stay up to date on the latest happenings in digital marketing