Growing mobile apps in 2024: 5 ways app makers are winning despite challenges

How are app publishers winning in a tough economy? How are they growing mobile apps despite so many economic, financial, and measurement challenges?

Let’s face it: 2024 isn’t looking pretty from a bunch of different perspectives.

- GDP growth is slowing in many major economies, including the U.S.

- Inflation is still high despite some progress

- Ad spend growth is now underperforming what GDP growth we are achieving

- Wars all over the world are still impacting economies, supply chains, consumer sentiment, and human lives (the worst part, of course)

In my recent chat at Mobile Apps Unlocked in Las Vegas, I talked about these problems but also the fact that top publishers are still winning: they’re still growing mobile apps. And I shared 5 reasons why they keep on winning despite the challenging circumstances.

A few days ago, MAU founder Adam Lovallo asked me to share that presentation in a long-form blog post.

So here we are.

Yep, there are macro challenges to growing mobile apps: growth, inflation, wars

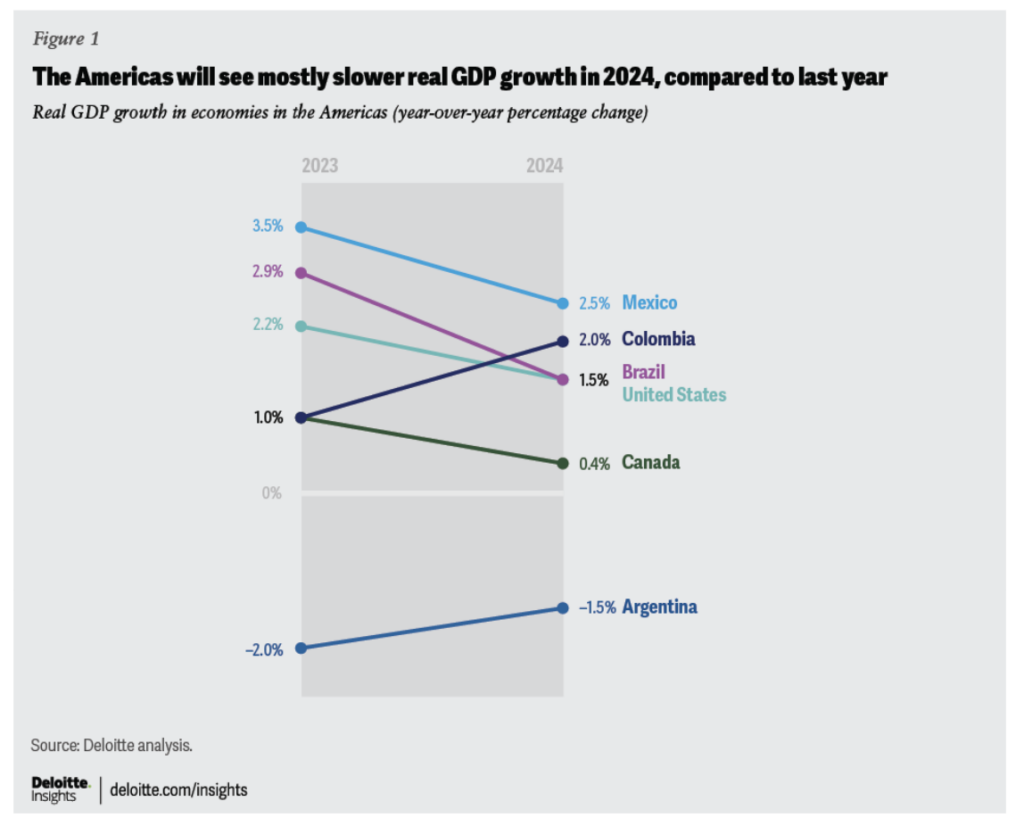

Deloitte tells us that the Americas will generally see slower GDP growth in 2024. The U.S. is down from 2.2% to 1.5%, Canada is slowing to an almost-invisible .4%, while Mexico and Brazil are both sharply down as well.

Columbia and Argentina are bucking the trend, as you can see.

Europe is projected to be a low-growth zone, according to the IMF, with Germany’s growth at just .5%, France at 1.%, and the UK at just .6%. Greater China, however, will be more robust, with growth in China projected to be at 4.6% and tiny Macau at an off-the-charts 27.2%.

Add to that inflation which the IMF says will still be high — particularly compared to recent years — at 5.8%. High inflation squeezes real income, which generally doesn’t rise as fast, leaving less left over for in-app purchases or subscriptions. (Which, yeah, makes it harder to grow mobile apps in 2 ways: monetization is harder, and growth capital is more expensive.)

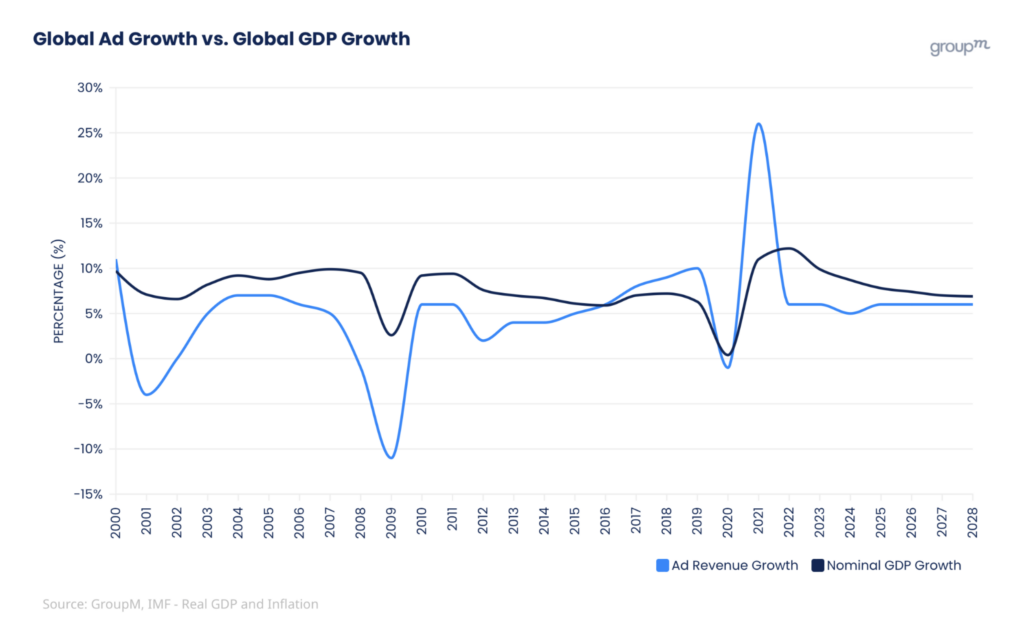

The tough thing for app publishers, UA pros, and monetization experts is that this is accompanied by global ad growth that is underpacing the already-anemic GDP growth across much of the globe. The massive Covid growth spike is long gone.

According to Dentsu, advertisers are now spending almost $140/person globally, up 75% from the early 2000s. That’s still extremely high, historically speaking, and growing from there is challenging despite the massive TAM expansion of advertisable digital content.

What about the mobile app ecosystem?

As necessary as privacy is (and I 100% mean that), it’s been a disaster for modern marketing machines. As we all know, growing mobile apps has become much harder.

There’s been a lot of change here:

- ATT

- Privacy Sandbox

- ITP

- Third-party cookies

- Facebook AMM deprecation

- GDPR

- DMA (Digital Markets Act)

- CCPA (California Consumer Privacy Act)

There’s lost signal due to ATT, but there’s also bad signal with SKAN, when SKAN and non-SKAN numbers don’t add up to real-world totals, organics and paid are hard to distinguish, and marketers deal with duplicated counting of installs from different partners and different measurement methodologies.

The result: it gets hard to trust channel performance numbers.

But it gets even better: all this joy is soon to arrive on Android.

(To be fair, Google is doing a lot to still enable targeting and retargeting in privacy-friendly ways, but we have yet to see what the performance degradation factor will be.)

Of course, it’s not only privacy that’s impacting our space, making growing mobile apps harder. We’re also seeing massive job loss in key companies in mobile gaming, particularly.

Far too many people have lost their jobs as we’ve seen layoffs from the likes of Unity, Amazon, Riot, Microsoft, Niantic, Sega, and more. Sure, there was overhiring during Covid — lots of it — and sure, there are lots of reasons for this.

But that doesn’t make it any easier.

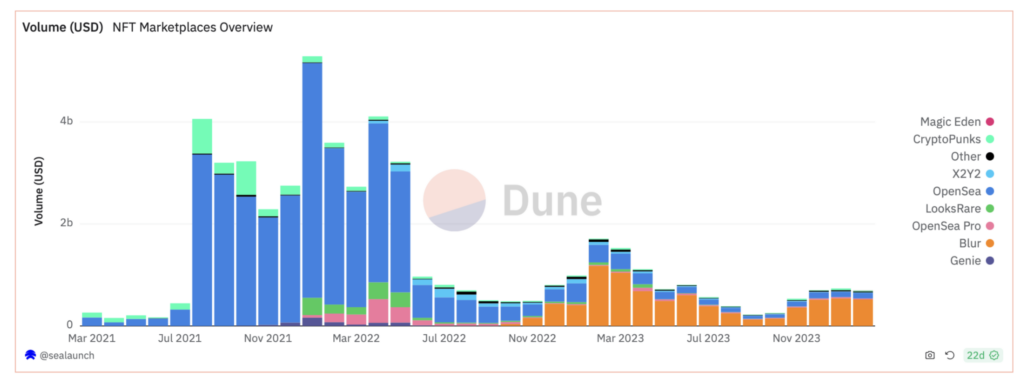

Add to all of this that web3 for app architecture and NFTs for app monetization didn’t save us: the crypto crash cratered web3 games. (I literally asked from the stage: can anyone think of a big web3 game … and the response was crickets from the crowd.)

Sure, crypto has since somewhat recovered, but NFTs, which many thought would be a cool and lucrative way to monetize games and apps … have not. Prove me wrong if you can, but web3 has not helped in growing mobile apps.

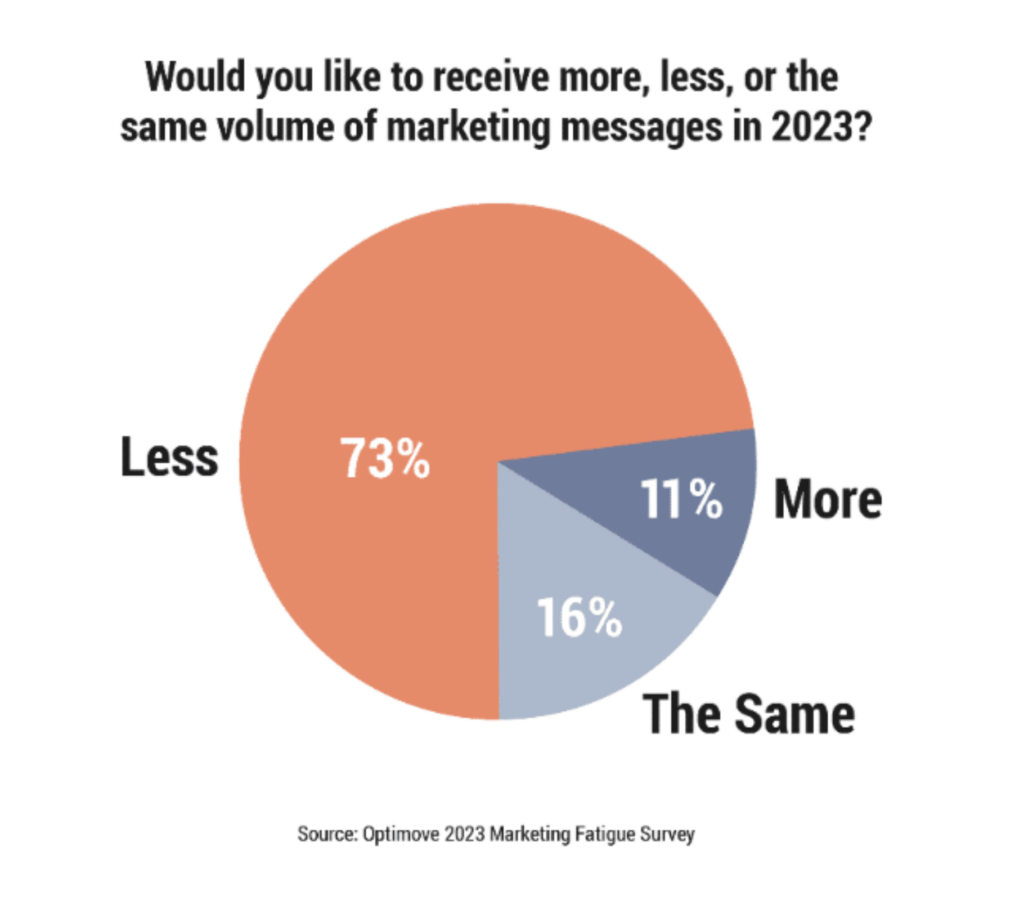

Plus, as advertising has become more and more prevalent in every facet of our lives, the backlash has become very visible as well. There’s ad blindness, of course, but there’s also ad fatigue — or even antagonism — as Optimove discovered late last year:

And no, Apple Vision Pro and Meta Quest are not going to save us: Nolan Sorrento is a great movie villain but his strategy for maximizing ad revenue while not inducing seizures is not going to work in the real world.

Subscriptions are great, but in an environment with high inflation and slow growth, everyone has to consider how many little monthly holes they can poke in their bank account before the well runs dry. Which is why RevenueCat found that the share of monthly subscribers retained after 12 months dropped by 14% last year.

So yeah: it’s challenging out there.

Hence the title of my presentation: 2024 WTF.

Growing mobile apps: 5 strategies that are working

Five strategies that are winning include:

- Getting in the fight

- Getting better measurement accuracy

- Going beyond last click

- Continuing to test new partners

- Starting to test entirely new channels

I’m going to walk through each one of them here …

1. Getting in the fight

Growing mobile apps is easier when you’re actually in the fight. You might laugh at participation trophies, but those who aren’t engaging can’t win.

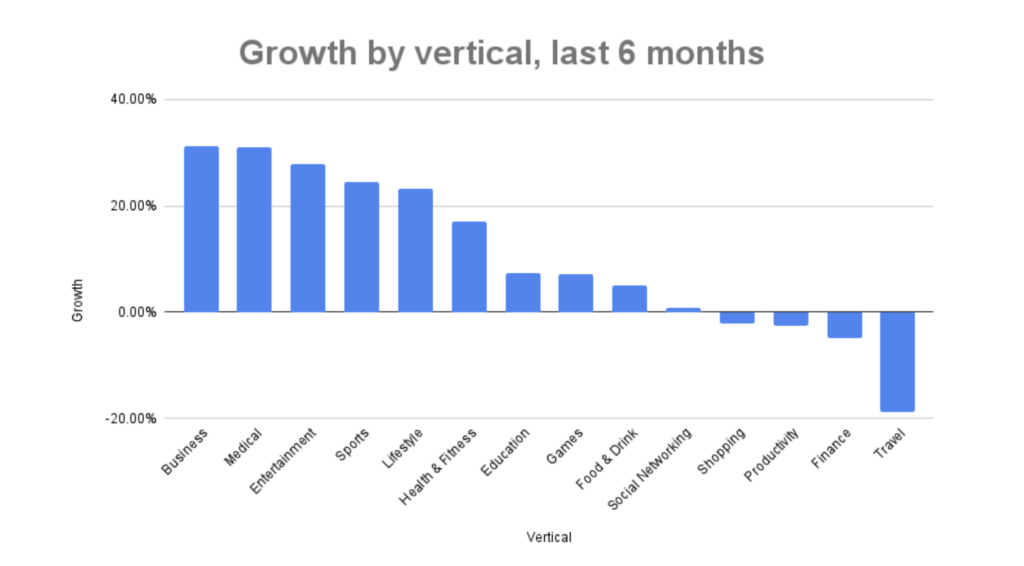

And the good news here is that across the board, ad spend by Singular customers is up 8% year over year for the last six months. That means top growth marketers are doubling down. And since they don’t do so when it’s not profitable, they’re reaping the rewards.

Not all verticals are equal here, though:

Plenty of verticals are seeing significant growth, but guess what: a ton of it is outside of games. Growing mobile apps is working right now, but these genres are seeing the most growth:

- Business

- Medical

- Entertainment

- Sports

- Health/fitness

2. Getting better measurement accuracy

SKAN and ATT threw the iOS growth space for a loop. But measurement accuracy is returning.

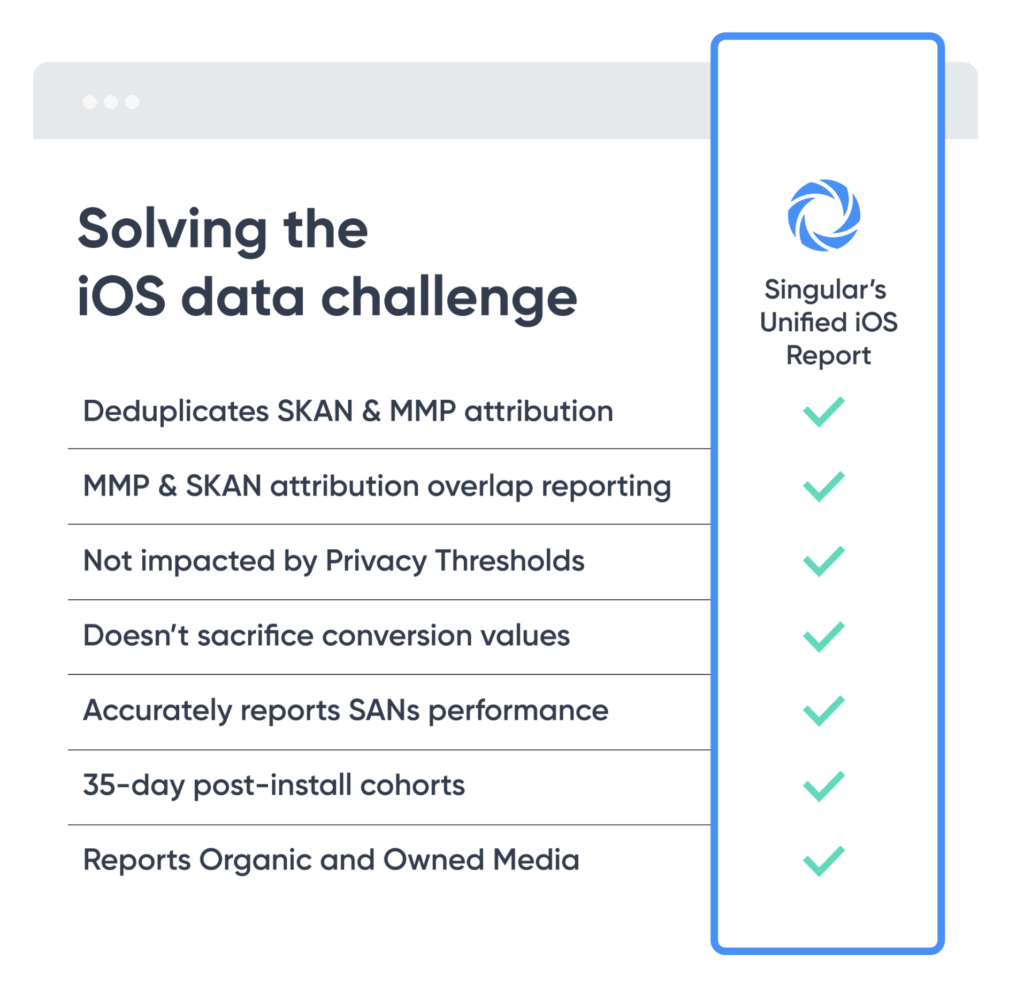

Last week, Singular unveiled Unified Measurement. It’s a massive leap forward.

Look: SKAN is here to stay. That means you need a solution that gives you the best data possible. Unified Measurement is an approach that uses multiple measurement methodologies at the same time, combined, to achieve significantly better results for people who are growing mobile apps.

SKAN by itself isn’t enough.

IDFV by itself, not enough.

IDFA: same, even if you’re getting a lot of yes from your ATT prompts.

Any other single method also is not enough.

Using Unified Measurement for the new Unified iOS Report, we’re seeing accurate de-duping of SKAN and MMP attribution, much more accurate partner performance, and true organics. The result is much better-measured ROI on paid campaigns, sane eCPIs, and, as a massive bonus, long 35-day post-install cohorts.

Even better, it’s all transparent, showing you the numbers from multiple measurement methodologies so that you can have confidence that this is not just a made-up number.

3. Going beyond last click

Third, we’re seeing top mobile growers go beyond last-click measurement.

Sure, the customer journey for a mobile game maybe isn’t as complex as a major life purchase. You’re not buying a car, after all. But there’s a heck of a lot more going on than 1 ad view, 1 click, 1 install, 1 open, and magically … huge ROI.

You have to go beyond last click to get a better sense of the factors combining in growing mobile apps successfully.

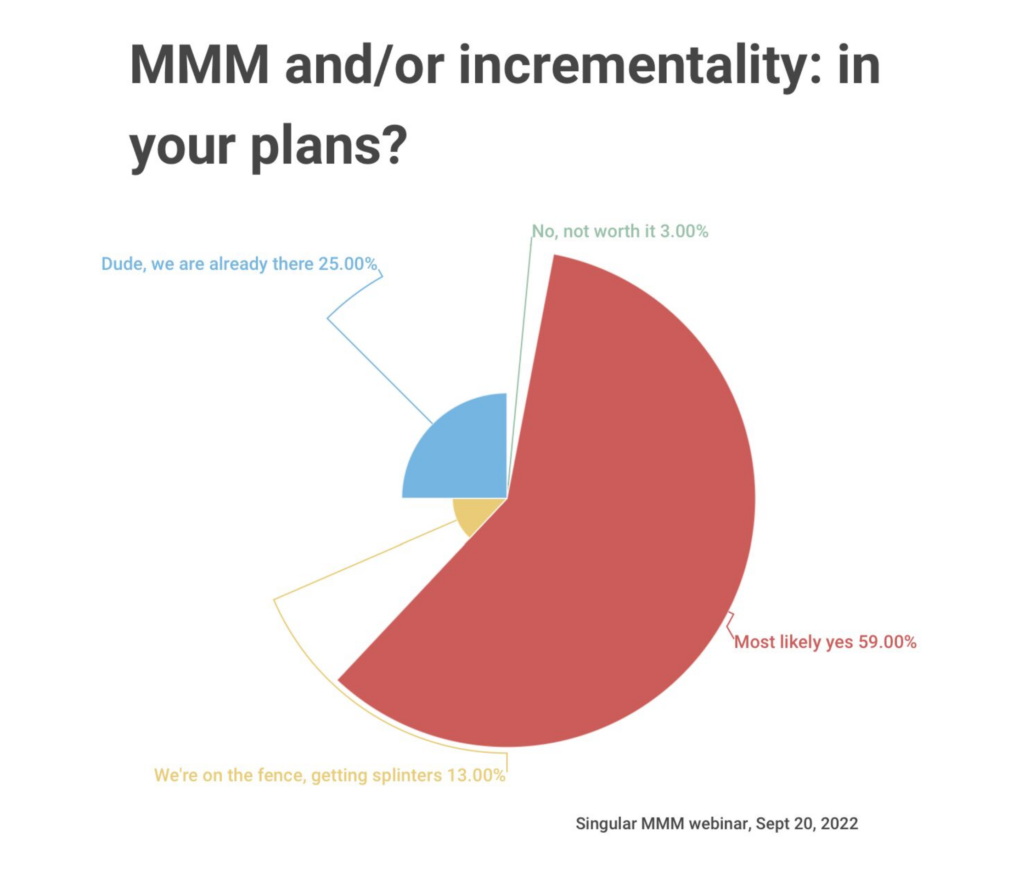

Last year when we asked, only 3% of mobile marketers told us MMM was not work exploring.

25% were already doing MMM, and 60% were working up to it. Those numbers are certainly higher now, and the reason why is simple: more signals, done well, boosts decision accuracy.

“The goal is to get as many signals as possible to make better decisions.”

– Edouard Favier, UA, A Thinking Ape

MMM highlights wasted spend, is fraud-resistant, shows when big changes are industry-wide shifts versus app-specific movements, and is a sanity check on partner and channel selection. Plus, with Singular, MMM is relatively easy and out of the box, making it a no-brainer addition to those who are growing mobile apps.

4. Continuing to test new partners

For the 2024 Singular ROI Index, one relatively tiny ad network came out of nowhere to rank on every category: geo, vertical, platform. Who is going to be that company next year?

There’s only 1 way to know, and that’s to test.

Also: having more ad partners is highly correlated with outsized growth. Every time I’ve checked the data … twice in the last 6-7 years at Singular and once at TUNE close to a decade ago, marketers who are testing more networks grow faster.

5. Starting to test entirely new channels

You need to think about testing entirely new channels, not just new partners.

As you might have guessed, I recently put together Singular’s ROI Index. Some things don’t hit the big numbers, but they clearly make a significant difference for specific apps. For example, UA spend for CTV is up 46% year over year for Singular clients. That’s a big movement.

Also, I keep hearing good things about out of home.

Other channels that I could see in the data working for specific apps and specific customers who were successfully growing mobile apps include:

- Custom SMS

- Newsletter

- Lockscreen ads

- No-store direct install

Look, your mileage may vary, but try things that make sense for your vertical, your target customer, your geographic location. Sometimes you might just hit a gold mine for high-value, low-expense user acquisition.

Summing up: lots of challenges, lots of opportunities

It’s not easy out there. Money is tight, the economy isn’t amazing for many, and growth can be hard to come by.

But some are still making it work, and Singular customers are growing their ad spend as well as their return. See which 1 or 2 or 3 of the 5 strategies will work for you.

And if we can help … let us know!

Stay up to date on the latest happenings in digital marketing